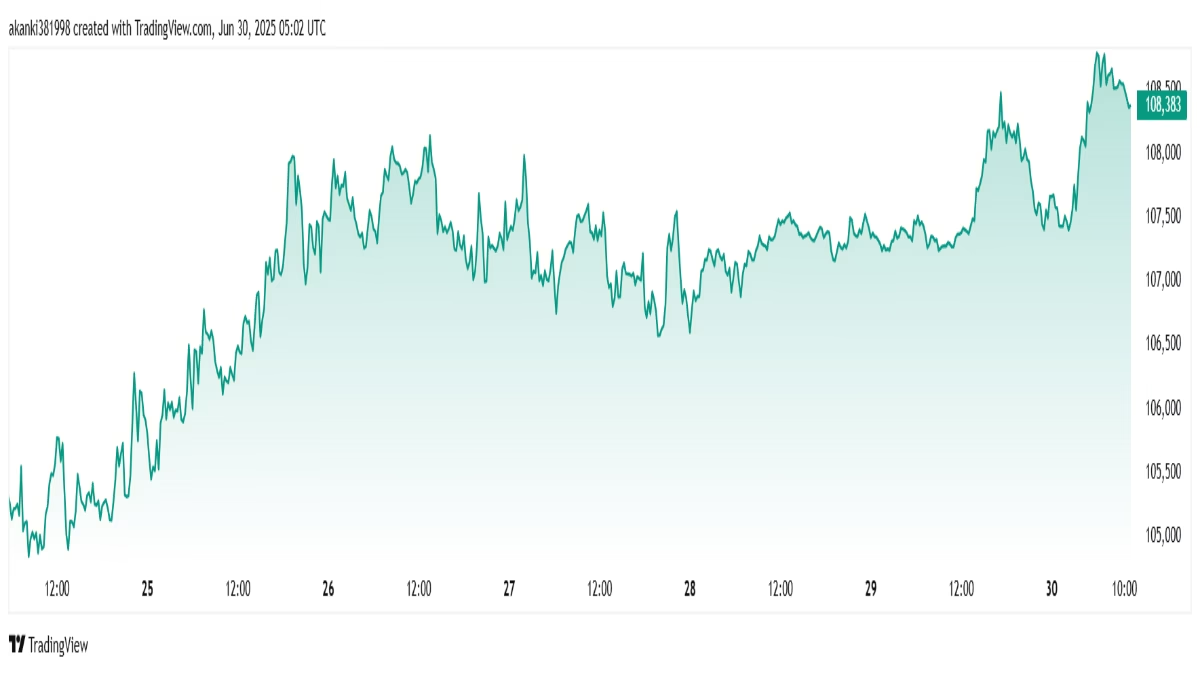

Bitcoin price (BTC) surged past $108,500 on June 30, 2025, setting the stage for what could become a historic weekly and monthly close above the $109,000 level. The sudden weekend momentum has left traders optimistic that Bitcoin could soon break all-time high candle closing records, signaling a strong start to Q3.

Table of Contents

Bitcoin Hits Two-Week Highs Amid Whale Activity

According to data from Cointelegraph Markets Pro and TradingView, BTC/USD gained over 1% in a 24-hour window, hitting a two-week high. The surge was partially attributed to whale activity, particularly the actions of the controversial Hyperliquid trader, James Wynn.

Wynn had opened a massive $13.9 million BTC short position with a liquidation price of $108,630. As Bitcoin’s price neared that threshold, other traders seemingly coordinated an attempt to trigger Wynn’s liquidation. Eventually, Wynn closed his short early and flipped long with 60 BTC, further fueling bullish sentiment.

🧠 What Experts Say About Bitcoin’s Long-Term Potential

The recent surge in BTC isn’t just short-term hype. Experts believe that regulatory clarity, institutional adoption, and upcoming BTC ETF developments could drive the next bull cycle. Here’s what some leading voices are saying:

- Anthony Pompliano, Bitcoin investor:

“Bitcoin’s infrastructure is stronger than ever. With mainstream money flowing in, $150K–$180K isn’t unrealistic by 2026.”

- Cathie Wood, CEO of ARK Invest:

“Bitcoin is the only digital asset with true institutional demand. Our models forecast a price target above $200,000 within the next 3–5 years.”

These bullish outlooks reflect a broader confidence in Bitcoin’s role as a hedge against inflation and a long-term store of value.

Market Structure Signals Bullish Momentum

Short-term technicals support the bullish outlook. Popular crypto analyst Autumn Riley posted on X:

“If you look at the 15-minute chart, the structure is bullish. Every time price sweeps a high, it reacts down but keeps making higher lows. The pressure from sellers is fading slowly.”

Meanwhile, trader BitBull noted a golden cross forming on Bitcoin’s MACD (Moving Average Convergence/Divergence) indicator—a strong signal of near-term bullish strength:

“Another signal which shows that bulls are in control. Low liquidity means slow movement, but expect a breakout once markets open.”

Can BTC Break Historic Resistance at $109K?

Crypto analyst Rekt Capital highlighted the potential for a historic weekly close above the last major resistance line:

“Bitcoin has never performed such a Weekly Close. In doing so, it would enable Bitcoin to enjoy a new uptrend into new All Time Highs.”

Historically, the highest weekly close for BTC sits just above $109,000 on Bitstamp. A close above this level would not only confirm strong momentum but could mark the start of a new market cycle.

💼 What It Means for Investors

For long-term holders and new investors, a breakout above $109K offers several signals:

- Confirmation of bullish market cycle continuation

- Potential inflow into altcoins as BTC dominance grows

- Strengthening institutional interest in digital assets

Glassnode data also revealed that long-term holders are accumulating aggressively, with over 800,000 BTC added in June 2025—marking the strongest “hodl run” in Bitcoin history.

🔒 Security & Scarcity Driving Demand

With Bitcoin’s halving event expected in mid-2026, market experts are already anticipating increased scarcity. Historically, halving cycles have led to massive price rallies in the 12–18 months that follow.

On-chain data also confirms that over 70% of BTC supply hasn’t moved in over 6 months, highlighting long-term conviction among holders.

📷 Chart Snapshot

📈 Conclusion: Q3 Starts With Big Bullish Energy

Bitcoin’s movement near the $109K resistance is being closely watched. If the weekly and monthly candles close above that level, it could unlock new highs and reshape short-term trading strategies.

As always, traders should stay cautious during low-liquidity weekends and monitor global economic events that could impact crypto markets.

🔗 More Finance News: JioBlackRock Liquid Fund NFO Launch

💡 CTA Paragraph at End

Stay tuned to Time of Hindustan for daily crypto updates, expert predictions, and price movement alerts. Don’t forget to follow us on Twitter for breaking BTC trends.

Author: Ankit Kumar

Editor-in-Chief, Time of Hindustan

📌 Stay Updated

Bookmark Time of Hindustan for more News and updates.