Introduction : BlackRock Acquires HPS

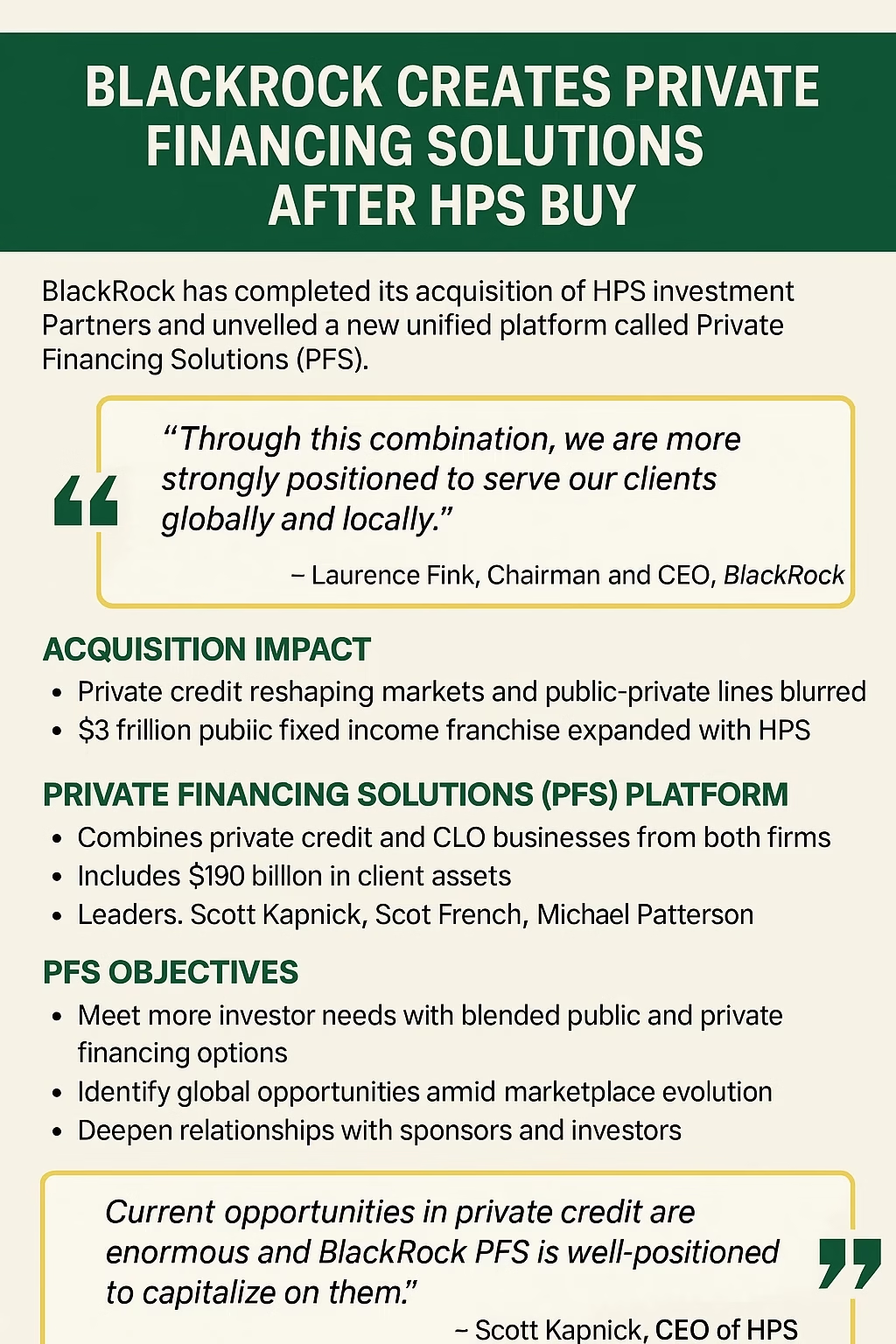

In a landmark development that is set to reshape the global credit landscape, BlackRock, Inc. has successfully completed the acquisition of HPS Investment Partners (HPS). This move underscores BlackRock’s strategic commitment to private credit markets and significantly enhances its ability to offer comprehensive financing solutions. With this acquisition, BlackRock is positioning itself as a leading provider of integrated private and public credit products, bringing together market expertise, global scale, and technological capabilities.

Private Credit: A Market in Transformation

Private credit is rapidly transforming the way financial markets operate. With rising demand for long-term capital and structural shifts in the financial ecosystem, financing activity is increasingly migrating from traditional banks to asset managers. This transition is largely driven by the growing needs of insurance companies, pension funds, sovereign wealth funds, family offices, wealth managers, and individual investors.

In response, asset managers are building more diversified portfolios that include both public and private credit instruments. The accelerating convergence of public and private markets is reshaping how institutional investors operate and transforming their strategies for credit allocation..

BlackRock Acquires HPS: A Strategic Integration

After BlackRock Acquires HPS, BlackRock gains a well-established leader in private credit and structured finance. HPS brings a suite of flagship funds, including:

- HPS Strategic Investment Partners (SIP)

- HPS Specialty Loan Fund (SLF)

- HPS Core Senior Lending Fund (CSL)

- HPS Corporate Lending Fund (HLEND)

These investment vehicles will retain their HPS branding but will now operate as part of “HPS, a part of BlackRock.” This brand continuity ensures investor trust while allowing for operational integration into the broader BlackRock platform.

Birth of BlackRock Private Financing Solutions (PFS)

After BlackRock Acquires HPS, BlackRock has launched a new business division—Private Financing Solutions (PFS). This platform integrates both firms’ strengths in private credit, general partner (GP) and limited partner (LP) solutions, and collateralized loan obligations (CLOs). PFS aims to offer a seamless experience for borrowers and investors, enhancing capital deployment opportunities while maintaining risk control.

Core Leadership and Vision

The newly created PFS division will be led by three seasoned professionals:

- Scott Kapnick – CEO of HPS and now a board observer at BlackRock

- Scot French

- Michael Patterson

Together, they bring decades of experience in credit markets and portfolio management. Their leadership will be instrumental in driving PFS’s future strategy.

Unmatched Scale and Capabilities

One of the core pillars of PFS will be its $190 billion integrated private credit franchise. This includes BlackRock’s well-established public fixed income businesses, such as:

- Fundamental Fixed Income, led by Rick Rieder

- Financial Institutions Group, led by Peter Gailliot

With this infrastructure in place, BlackRock can now cater to the evolving preferences of global investors who are increasingly agnostic about the distinction between public and private markets.

Delivering Comprehensive Investment Solutions

The PFS platform is designed to simplify how clients access yield-generating credit products. It offers a wide array of custom solutions across the credit spectrum, making it easier for investors to diversify and optimize their portfolios.

Whether clients are seeking high-yield opportunities, structured lending solutions, or customized GP/LP investment models, PFS provides a single-window gateway to meet those needs.

The division will also prioritize:

- Origination of large-scale private debt transactions

- Customized capital solutions for sponsors

- Liquidity management and risk mitigation tools

- Seamless integration with BlackRock’s Aladdin platform

Client Benefits and Strategic Importance After BlackRock Acquires HPS

According to BlackRock Chairman and CEO Laurence D. Fink, the integration is more than a merger of businesses—it’s about reimagining how financial services are delivered in a fast-changing global market.

“BlackRock has always looked at the full breadth of our clients’ needs in everything we do,” Fink noted. “This partnership enhances our ability to serve clients both globally and locally, guided by our unified One BlackRock culture. It enables us to offer integrated solutions that effectively combine public and private market strategies.”

The move will also allow BlackRock to reduce friction in investment processes. With fewer touchpoints required to deliver complex financing solutions, clients and borrowers can expect improved speed, flexibility, and efficiency.

HPS Leadership Excited for Next Phase After BlackRock Acquires HPS

Scott Kapnick, CEO of HPS, expressed enthusiasm about joining BlackRock:

We’re excited to partner with BlackRock and elevate the HPS success story to even greater heights. The private credit market presents vast opportunities, and capitalizing on them demands a blend of entrepreneurial spirit, strong risk management, global capabilities, and a robust platform. BlackRock Private Financing Solutions brings all these strengths together to benefit our clients, investors, shareholders, and team members.

Market Implications and Future Outlook

This acquisition and integration come at a time when institutional demand for private credit is surging. Rising interest rates, tighter banking regulations, and increased demand for capital formation are all contributing to this trend. With PFS (BlackRock Acquires HPS), BlackRock not only expands its product suite but also solidifies its role as a dominant force in next-generation credit markets.

In particular, the integration is expected to:

- Enhance BlackRock’s ability to originate proprietary deals

- Deepen relationships with corporate borrowers and sponsors

- Improve operational synergies and credit analytics

- Deliver better long-term returns to investors

Transaction Advisors and Legal Counsel

This high-profile deal (BlackRock Acquires HPS) was facilitated by several leading financial and legal institutions:

- BlackRock Advisors:

- Perella Weinberg Partners LP (Lead Financial Advisor)

- Morgan Stanley & Co. LLC

- Skadden, Arps, Slate, Meagher & Flom LLP

- Clifford Chance LLP

- HPS Advisors:

- J.P. Morgan Securities LLC (Lead Financial Advisor)

- Goldman Sachs & Co. LLC

- BofA Securities, Inc.

- Deutsche Bank Securities Inc.

- BNP Paribas

- RBC Capital Markets

- Fried, Frank, Harris, Shriver & Jacobson LLP (Legal Counsel)

Conclusion: A New Era in Credit Investing

The launch of Private Financing Solutions represents a significant milestone in BlackRock’s evolution. By integrating HPS’s specialized knowledge and strong track record with BlackRock’s expansive reach and technological capabilities, the combined entity is well-positioned to lead the future of private credit investing.

Investors and borrowers alike now have access to a more cohesive, data-driven, and opportunity-rich credit platform—setting the stage for long-term growth in a world where traditional boundaries between public and private finance are fading.(BlackRock Acquires HPS)

Author: Ankit Kumar – Finance & Business Editor

Related Article: JioBlackRock Liquid Fund NFO Opens June 30: What Investors Should Know

FOLLOW US ON SOCIAL MEDIA