Introduction – A New Era for MSME Financing

For decades, one of the biggest challenges for India’s Micro, Small, and Medium Enterprises (MSMEs) has been getting timely credit. The need for collateral often discourages small business owners, who may not have property or other high-value assets to pledge.

The New Credit Guarantee Scheme 2025 is changing that reality. Designed by the Government of India to boost entrepreneurship and growth, it allows eligible MSMEs to get a collateral-free MSME loan with minimal paperwork, lower interest rates, and faster disbursement.

If you’re a small business owner looking to expand, buy equipment, or manage working capital, this guide will help you understand exactly how to take advantage of the scheme.

1. What is the New Credit Guarantee Scheme 2025?

The Credit Guarantee Scheme is a government-backed initiative where loans given by banks or NBFCs to MSMEs are covered under a government guarantee.

In simple terms — if a borrower defaults, the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) will reimburse the lender for a significant portion of the loan amount. This guarantee encourages banks to offer a collateral-free MSME loan to small businesses that otherwise struggle to get credit.

Key Updates in 2025:

- Increased maximum loan amount covered from ₹2 crore to ₹5 crore.

- Reduced guarantee fees for women entrepreneurs and businesses in the manufacturing sector.

- Digital, paperless loan approval process through the Udyam Portal.

- Priority given to green and sustainable business projects.

2. Benefits of Getting a Collateral-Free MSME Loan in 2025

a. No Asset Risk

You don’t need to mortgage property or pledge valuable assets to get funding.

b. Lower Interest Rates

Government-backed guarantees make banks more confident, often leading to lower rates.

c. Faster Approvals

The scheme’s integration with Udyam Registration ensures quicker verification.

d. Flexible Usage

Funds can be used for expansion, working capital, technology upgrades, or marketing.

e. Inclusivity

Special incentives for women entrepreneurs, SC/ST business owners, and rural enterprises.

3. Eligibility Criteria for Collateral-Free MSME Loan

To qualify under the New Credit Guarantee Scheme 2025, your business must:

- Be an MSME registered under the Udyam Portal.

- Operate in manufacturing, trading, or service sectors (excluding restricted categories).

- Have a clean repayment history (or minimal defaults).

- Be seeking a loan of up to ₹5 crore.

- Not be a defaulter under any government loan scheme.

Why MSMEs Missing Out on PLI Schemes—Hidden Criteria Explained 2025

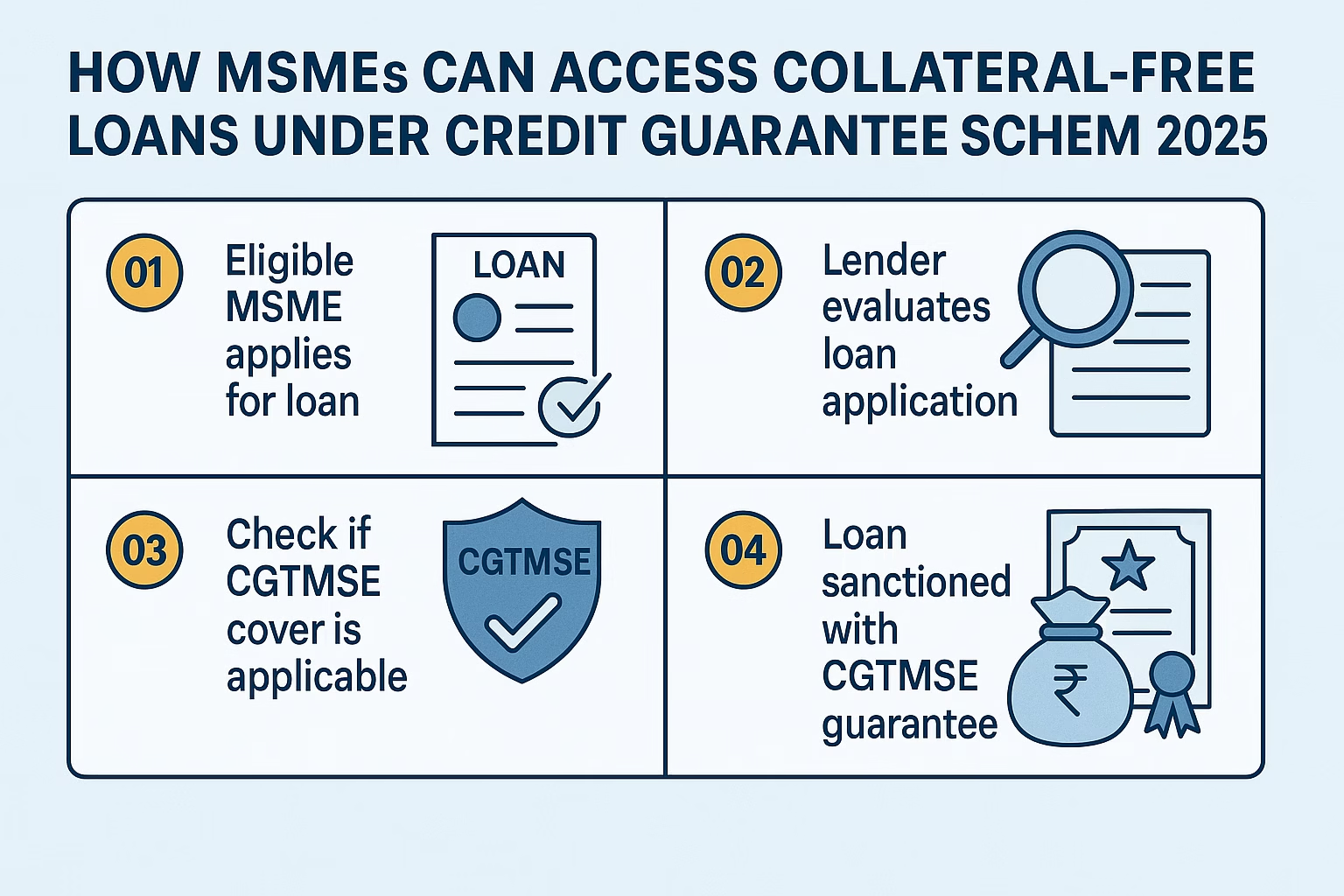

4. How to Apply for the Loan – Step-by-Step

Here’s a quick roadmap to securing your collateral-free MSME loan:

Step 1: Register on Udyam Portal

Make sure your MSME is officially registered. You’ll get a unique Udyam Registration Number (URN).

Step 2: Choose Your Lender

Select from banks, NBFCs, or fintech lenders participating in the CGTMSE program.

Step 3: Prepare Documents

Typically required:

- Business PAN & Aadhaar

- GST registration certificate

- Last 2–3 years’ ITRs

- Bank statements

- Business plan & loan purpose statement

Step 4: Apply Online or Offline

Many lenders now allow you to apply directly through their website or app.

Step 5: Verification & Approval

Your lender will verify details, check your credit score, and submit your loan proposal to CGTMSE for guarantee cover.

Step 6: Disbursement

Once approved, the loan is credited to your account — without any collateral required.

5. Tips to Increase Your Loan Approval Chances

- Maintain Good Credit History – A CIBIL score above 650 improves approval rates.

- Show Clear Repayment Plan – Lenders like businesses with predictable revenue streams.

- Leverage Government Portals – Use GEM (Government e-Marketplace) and MSME Samadhan to strengthen your credibility.

- Opt for Smaller Initial Loan – If you’re new to credit, start small and build trust.

6. Common Mistakes to Avoid

- Applying to multiple lenders at the same time (hurts your credit score).

- Ignoring repayment schedules (defaulting can block future benefits).

- Providing incomplete documentation.

- Not checking eligibility before applying.

7. Impact of the Scheme on MSME Growth

The new scheme is expected to boost MSME credit flow by ₹3 lakh crore in the next two years. By making the collateral-free MSME loan more accessible, the government aims to:

- Encourage formalization of small businesses.

- Increase manufacturing output.

- Promote innovation and technology adoption.

- Reduce unemployment through new business opportunities.

8. FAQs About Collateral-Free MSME Loan in 2025

Q1. Can startups apply for this scheme?

Yes, as long as they are registered under MSME and meet eligibility criteria.

Q2. What is the interest rate for a collateral-free MSME loan?

Rates vary between 7–12% depending on the lender and applicant profile.

Q3. Is a personal guarantee required?

In most cases, yes — but no physical collateral is needed.

Q4. How long does approval take?

Anywhere from 7 days to 4 weeks, depending on documentation and lender.

Conclusion – Your Growth Without Risk

The New Credit Guarantee Scheme 2025 is a golden opportunity for small businesses to get affordable, quick funding without risking their assets. Whether you’re expanding, upgrading machinery, or stabilizing cash flow, the collateral-free MSME loan could be your growth engine.

With the government covering a large share of the risk, it’s now easier than ever to secure the funding you need to compete and thrive in the market.

FOLLOW TIME OF HINDUSTAN ON FB