Despite numerous schemes, announcements, and so-called support programs, thousands of Indian MSMEs (Micro, Small, and Medium Enterprises) continue to struggle with getting access to formal credit. If you’ve applied and wondered why your application got rejected or heard of others facing the same fate, you’re not alone. In this deep-dive, we uncover the real reasons behind MSME loan rejection and offer a step-by-step guide on how to fix it in 2025.

🧠 First, Why This Topic Matters in 2025

India’s MSME sector contributes over 30% to the GDP and employs more than 11 crore people. But when it comes to loans, these businesses are often left out of the picture. The irony? Government-backed loan schemes like CGTMSE, Mudra, PMEGP, and Emergency Credit Line Guarantee Scheme (ECLGS) exist—yet MSME loan rejection continues to be a widespread issue.

Let’s find out why.

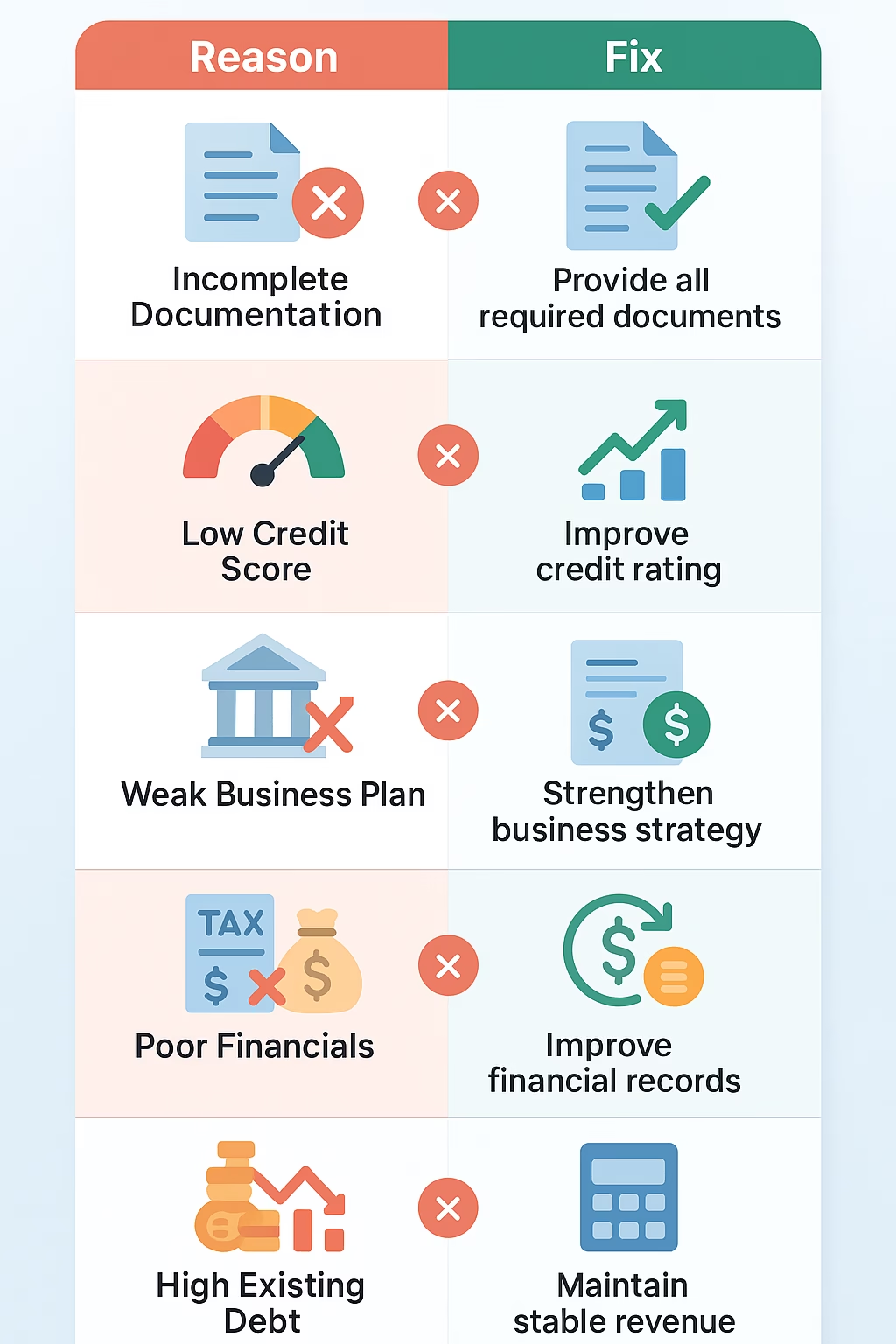

🔍 Reason 1: Poor CIBIL or Credit History

A large number of MSME loan rejections are directly related to the owner’s or business’s poor credit score. Lenders rely heavily on your creditworthiness, and a score below 650 immediately raises red flags.

✅ Fix:

- Check your CIBIL score regularly (via platforms like CIBIL or CRIF Highmark)

- Clear outstanding dues or restructure them legally

- Maintain a good credit mix (secured + unsecured loans)

📝 Pro Tip: Even a co-applicant’s bad credit can lead to your MSME loan rejection.

📑 Reason 2: Lack of Collateral (Despite Collateral-Free Schemes)

Government schemes promise collateral-free MSME loans, but banks still demand property or security, especially for higher amounts or if you have no prior loan history.

✅ Fix:

- Apply under schemes like CGTMSE (Credit Guarantee Fund Trust for Micro and Small Enterprises)

- Use alternative lenders (NBFCs or digital lenders) who actually honour collateral-free terms

- Apply for lower ticket size loans to build credit first

📋 Reason 3: Poor Documentation or Application Errors

Something as small as a missing signature, mismatched address, or outdated ITR can cause MSME loan rejection. Loan officers don’t have the time or incentive to chase incomplete files.

✅ Fix: MSME loan rejection

- Double-check all documents: GST filings, bank statements, ITRs (last 3 years), company PAN, Udyam registration

- Get your financials audited if possible—it builds lender trust

- Consider hiring a loan consultant for large applications

🧾 Reason 4: Unregistered or Informal Business Structure

If your MSME isn’t registered on the Udyam portal, your application might not even get processed. Banks are increasingly insisting on Udyam registration as a prerequisite.

✅ Fix:

- Register your business immediately at https://udyamregistration.gov.in

- Keep your registration and activity code updated

- Always ensure that your bank account should be on business name, not your personal name.

🏦 Reason 5: Wrong Choice of Lender or Scheme

Each scheme has its own eligibility. Applying for a PMEGP loan when you’re better suited for Mudra, or applying at a large private bank when an NBFC is more flexible, can cause unnecessary MSME loan rejection.

✅ Fix:

- Understand which schemes you’re eligible for. For example:

- Mudra Loan: For small working capital (₹50K–₹10L)

- CGTMSE: For startups and existing MSMEs without collateral

- PMEGP: For manufacturing/service-based projects with subsidy

- SIDBI Loans: For tech-driven MSMEs

- Choose lenders who specialize in your industry or region

📉 Reason 6: Declining Business Turnover or Activity

If your turnover has declined (like many post-COVID), banks may hesitate, fearing default. Low sales = low repayment capacity in their eyes.

✅ Fix:

- Show business recovery trends in your application

- Include new orders, contracts, or client testimonials

- Attach a business plan for 2025 that shows projected growth

💡 Note: You can apply for restructuring or top-up loans even if your turnover was low in 2023-24, under revised RBI norms.

🚫 Reason 7: Previous Loan Default (Even Minor)

Banks share data across credit bureaus and remember even small defaults or delays—even if it was not your fault.

✅ Fix:

- Write a clarification letter explaining the delay

- Get a NOC from past lenders

- Resolve old NPAs or negotiate settlements before reapplying

🧰 Step-by-Step Fix to Avoid MSME Loan Rejection in 2025

Here’s your fix-it roadmap:

🔁 Step 1: Check Eligibility Before Applying

Use online tools or consult with loan aggregators to find the best-suited scheme and lender.

📄 Step 2: Organize All Documents

Have a ready folder with:

- Udyam certificate

- GST filings (last 6–12 months)

- ITRs (3 years)

- Latest bank statements (6 months)

- Rent agreements, utility bills (for business address proof)

💼 Step 3: Register on Govt Portals

- GeM (for govt procurement)

- MSME Samadhaan (for invoice delay complaints)

- TReDS (for early invoice payments)

🧾 Step 4: Improve Credit Score & Track Record

Pay vendors and EMI on time. Don’t max out your OD limit.

🧠 Step 5: Apply in Stages, Not All at Once

Start with a small Mudra loan (₹1–2L) or working capital line. Build trust, then go for larger amounts.

💬 Real MSME Owner Experiences

🔸 “I had a stable turnover but still faced MSME loan rejection. Turned out, my ITR showed net loss due to depreciation—which banks didn’t bother to analyze.” — Amit Sinha, Jaipur

🔸 “A local NBFC gave me a ₹7L loan under CGTMSE without collateral. PSU banks didn’t even call back.” — Sarita Joshi, Surat

📣 What the Govt Is Doing (and Still Needs to Do)

In 2025, several changes are underway:

- RBI is working with SIDBI to integrate AI-based risk profiling for MSMEs with thin credit files.

- Digital platforms like JanSamarth are helping match schemes to businesses.

- But bottle-necks like poor KYC verification and offline bank processes still persist.

🔚 Final Thoughts

MSME loan rejection is not always your fault—but fixing it is your responsibility. Most rejections boil down to avoidable errors, unclear documentation, or mismatched lender expectations.

India needs MSMEs to thrive, and access to credit is non-negotiable in that journey. Use this guide to make sure your next loan application not only goes through—but helps you grow.

Bookmark Time of Hindustan for more news.