Introduction—Why 2025 Is a Turning Point for EV Buyers

Electric vehicles (EVs) have moved from niche products to mainstream options in India, especially after state governments started introducing attractive incentives for buyers. But there’s a lesser-known benefit that might save you thousands of rupees—lower EV loan rates.

In 2025, several Indian states are updating their electric mobility policies. While most people focus on subsidies and registration fee waivers, the real game-changer could be how these policies influence car loan interest rates for EVs. This shift could make owning an EV not only eco-friendly but also financially smarter.

1. How State EV Policies Affect Loan Interest Rates

State EV policies influence lenders in multiple ways:

- Direct Interest Subsidies: Some states reimburse a part of the interest paid on EV loans.

- Government-Backed Risk Coverage: Policies reduce the lending risk for banks, leading to lower EV loan rates.

- Special Credit Lines: Dedicated funds from state governments push banks to design EV-specific loan products.

For example, Delhi’s EV policy offers loans with interest rates 1–2% lower than standard car loans, supported by government incentives. Maharashtra, Tamil Nadu, and Gujarat are also considering similar measures in 2025.

2. Why 2025 Policies Are More Aggressive

2025 is different because states are racing to meet India’s 2030 EV adoption targets. The new policies are structured to reward both buyers and lenders. With more pressure from the central government to push adoption, states are using interest rate cuts as a key strategy.

This means that if you plan to buy an EV this year, you could lock in an EV loan rate significantly lower than what you’d get for a petrol or diesel vehicle.

3. Examples of State-Specific Benefits

Let’s look at some examples of how state policies directly reduce costs for EV buyers in 2025:

| State | Subsidy on Interest | Loan Tenure Benefit | Additional Perks |

|---|---|---|---|

| Delhi | Up to 2% interest subsidy | 5–7 years | No road tax |

| Maharashtra | 1.5% rate cut | Flexible EMI | Free charging for 1 year |

| Gujarat | Interest buy-back program | Up to 8 years | Registration fee waiver |

| Tamil Nadu | Special green loan scheme | 0 processing fee | Priority delivery for EVs |

These programs directly reduce your total repayment, making your EV loan rates more attractive than traditional car financing.

4. The Role of Banks and NBFCs

Banks and non-banking financial companies (NBFCs) respond to state policies in real time. When states provide subsidies or credit guarantees, lenders pass on the benefits to customers. This can lower EV loan rates by 0.5% to 3%, depending on your credit profile and the state you live in.

Many banks now even have a dedicated EV financing desk to handle applications faster and approve loans with minimal paperwork.

5. Why Lower EV Loan Rates Matter More Than Subsidies

While upfront purchase subsidies grab headlines, interest rate savings can be just as impactful—especially for people taking long-tenure loans.

Example:

- Loan amount: ₹10 lakh

- Tenure: 7 years

- Standard rate: 9% → Total interest ~ ₹3.59 lakh

- EV loan rate: 7% → Total interest ~ ₹2.73 lakh

Savings: ₹86,000 over the loan period.

This is pure financial gain, even before accounting for fuel savings and maintenance benefits.

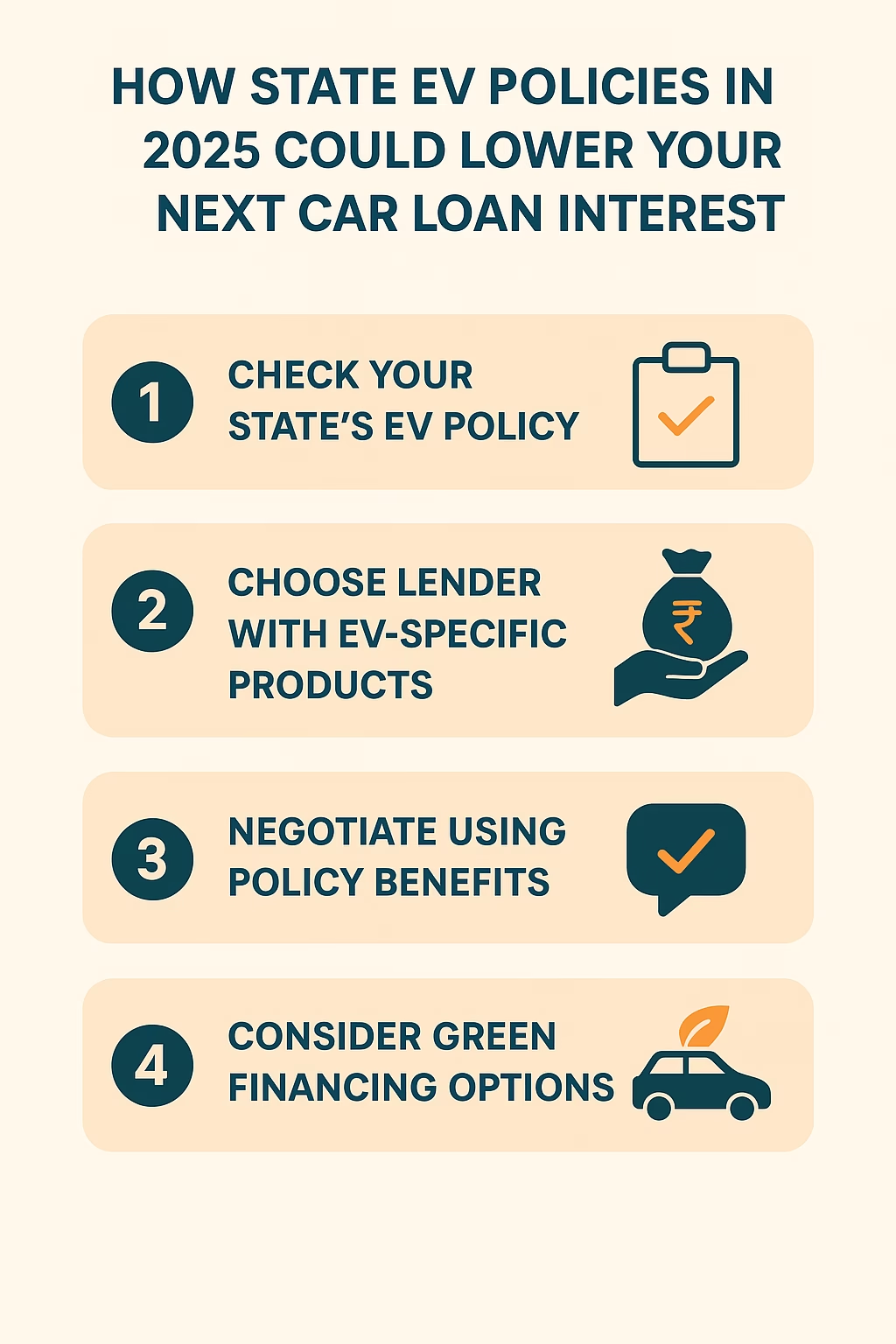

6. Steps to Get the Best EV Loan Rate in 2025

If you’re planning to buy an EV this year, follow these steps:

- Check Your State’s EV Policy: Look for 2025 updates—new incentives might apply.

- Choose Lenders with EV-Specific Products: Not all banks offer discounted EV loan rates.

- Negotiate Using Policy Benefits: Show lenders the subsidies your state offers to get better terms.

- Consider Green Financing Options: Some banks offer additional perks like lower processing fees for EVs.

- Apply Early: Funds for subsidies may be limited and offered on a first-come basis.

How Battery Swapping Could Cut Your EV Charging Costs by 40% in 2025

7. The Future of EV Financing

By 2027, EV financing might become cheaper than conventional auto loans across most states. Analysts predict that EV loan rates will continue to drop as the market matures, battery prices fall, and charging infrastructure expands.

The Indian government is also considering nationwide EV interest subvention programs, which could further boost affordability.

8. Should You Buy Now or Wait?

If you have your eye on an EV, 2025 might be the ideal time to act. Policy benefits are strong, banks are competitive, and manufacturers are offering exchange bonuses. Waiting could mean missing out if subsidies run out or policies change.

Conclusion – Don’t Miss the Interest Rate Advantage

The real secret in India’s EV adoption drive isn’t just about subsidies or zero road tax—it’s about securing a lower EV loan rate. With states stepping up in 2025, buyers who take advantage of these incentives could save lakhs over their loan tenure.

If you’re serious about buying an EV, now is the time to explore your state’s policy, compare lender offers, and lock in the lowest EV loan rate possible.

FOLLOW TIME OF HINDUSTAN