Introduction

The Indian automobile market is buzzing with one big question: How will GST 2.0 impact on cars? Ever since the new Goods and Services Tax (GST 2.0) rules were announced, car buyers, owners, and even lenders have been curious about its effect on pricing, insurance, EMIs, and overall ownership.

Cars in India are not just vehicles – they are aspirational assets. But with GST 2.0 rolling out, ownership costs are set to change significantly. Whether you’re planning to buy a new car, already paying EMIs, or renewing your insurance, understanding the GST 2.0 impact on cars can help you make smarter financial decisions.

In this article, we’ll break down everything: car prices, insurance premiums, loan EMIs, and long-term ownership costs under GST 2.0.

What is GST 2.0 and Why Does It Matter for Car Owners?

GST 2.0 is the revised version of India’s Goods and Services Tax system, simplified for compliance and aimed at reducing cascading taxes. For car buyers and owners, the biggest highlight is how tax slabs are being adjusted on vehicles, insurance products, and financial services.

Key reasons why GST 2.0 matters for car owners:

- Vehicle Tax Slabs Revisited – Different categories of cars (hatchbacks, sedans, SUVs, EVs) will see different tax treatments.

- Insurance Premium GST Change – Car insurance premiums will now have a restructured GST component.

- Loan EMI Adjustments – Financial services tax is revised, impacting processing fees, interest, and EMI structures.

- Resale and Ownership Costs – Even second-hand cars and maintenance bills are affected by GST 2.0.

Simply put, GST 2.0 impact on cars is not limited to the sticker price – it touches every stage of ownership.

GST 2.0 Impact on Car Prices

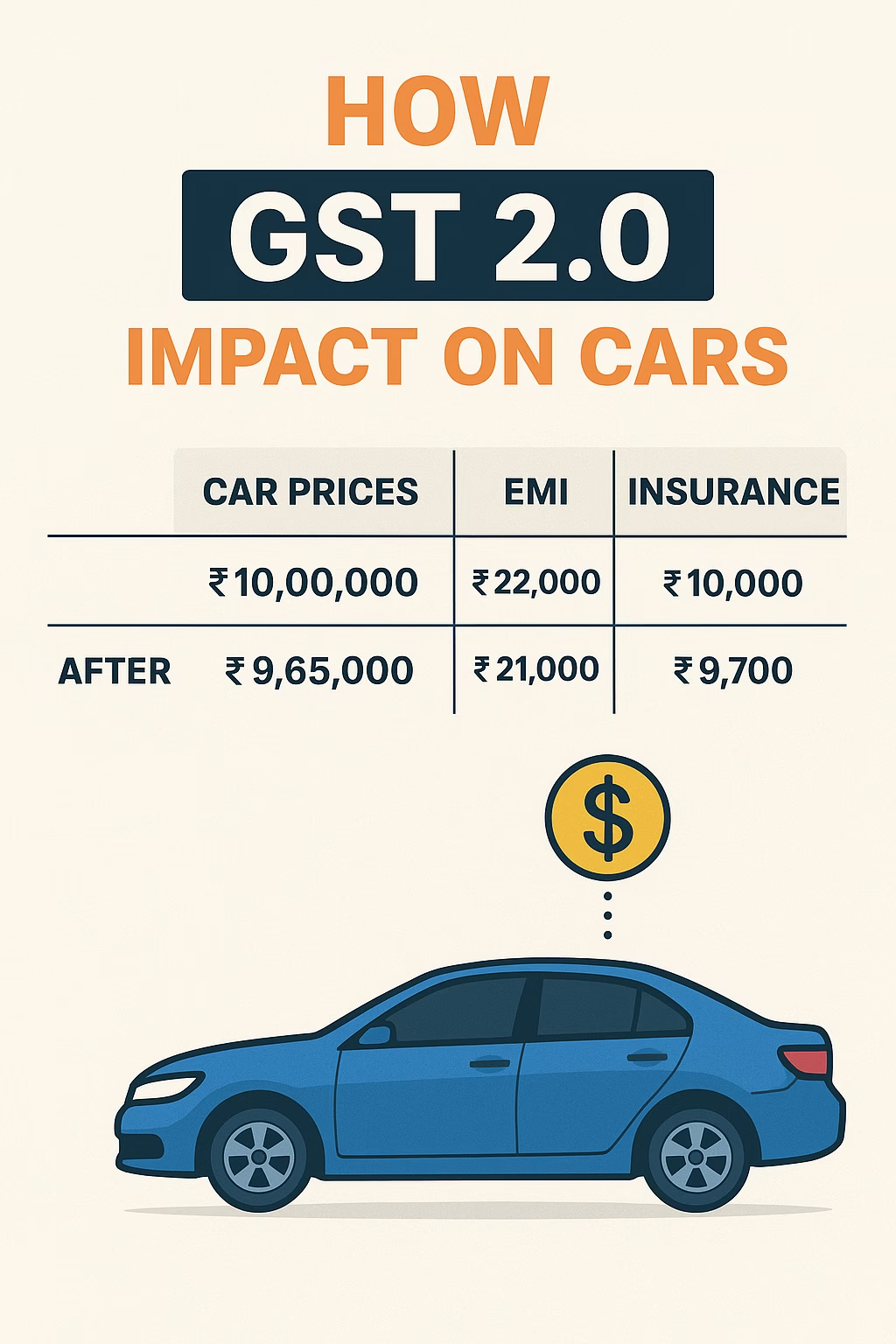

One of the most immediate effects of GST 2.0 is visible in car prices.

- Entry-Level Cars: Small hatchbacks under ₹10 lakh are expected to get cheaper as tax rates have been streamlined.

- Mid-Segment Sedans: Marginal reduction in price, though not as significant as hatchbacks.

- Luxury Cars & SUVs: GST 2.0 has brought in higher cess for premium vehicles, meaning luxury buyers may have to pay more.

- Electric Vehicles (EVs): Huge winners under GST 2.0, as the government pushes green adoption by keeping EV tax slabs at the lowest.

👉 If you’re planning to buy a car, the GST 2.0 impact on cars will likely benefit budget and EV buyers the most.

GST 2.0 Impact on Car Insurance

Car insurance is mandatory in India, but under GST 2.0, the premium you pay changes.

- Earlier, GST on car insurance was 18%. Under GST 2.0, the rate has been rationalized to 16% for basic insurance plans.

- Comprehensive policies and add-ons like zero depreciation, engine cover, or roadside assistance also fall under the new slabs.

- EV insurance premiums get a bigger cut due to government subsidies and GST benefits.

For a car owner, this means:

- Lower annual premiums for most mass-market cars.

- Luxury car insurance may still remain high due to cess and higher IDV values.

- Renewal costs should drop slightly, easing the burden on long-term owners.

Thus, the GST 2.0 impact on cars extends beyond just the buying stage—it reduces recurring insurance costs for many.

GST 2.0 Impact on Car Loan EMIs

A huge number of Indian car buyers depend on loans. Even small tweaks in tax on loan processing fees and interest can make a difference.

Here’s what GST 2.0 changes for loans:

- Processing Fees: Earlier taxed at 18%, now revised to 16%.

- Loan EMI Interest: While interest is not directly taxed, associated banking charges under GST 2.0 are reduced.

- Foreclosure Charges: Lower GST means slightly reduced penalties if you close your loan early.

For a 5-year car loan of ₹8 lakh, this could save you around ₹8,000–₹10,000 in total cost.

This makes financing more attractive, proving again how the GST 2.0 impact on cars is designed to encourage affordability.

GST 2.0 and Car Ownership Costs

Beyond buying and financing, owning a car involves fuel, maintenance, insurance renewals, and resale.

- Maintenance & Servicing: Car repair services earlier had 18% GST, now down to 16%, which means cheaper servicing bills.

- Spare Parts: Most spare parts fall under reduced tax slabs, cutting ownership costs further.

- Second-Hand Cars: GST 2.0 rationalizes the valuation method, making resale easier and more transparent.

This ensures that the GST 2.0 impact on cars isn’t just short-term—it lowers lifetime ownership expenses for middle-class families.

RELATED : Top 10 Cars Price Drop After GST 2.0 India

Real-Life Example of GST 2.0 Impact

Let’s consider Ravi, a buyer in Delhi planning to purchase a hatchback worth ₹8 lakh.

- Before GST 2.0: On-road price ~ ₹9.6 lakh (including 18% GST and insurance).

- After GST 2.0: On-road price ~ ₹9.2 lakh (due to reduced GST and lower insurance tax).

Savings: Nearly ₹40,000 upfront + reduced insurance premiums yearly.

This simple case shows how the GST 2.0 impact on cars can directly help consumers.

Winners and Losers of GST 2.0 in Cars

- Winners:

- Small car buyers

- EV buyers

- Middle-class families with loans

- Second-hand car owners

- Losers:

- Luxury car buyers (higher cess)

- Imported vehicle enthusiasts (no major tax relief)

Overall, the GST 2.0 impact on cars is progressive—it makes cars more affordable for the majority while taxing luxury consumption higher.

Frequently Asked Questions (FAQs)

1. Does GST 2.0 make cars cheaper in India?

Yes, small cars and EVs are cheaper, while luxury cars may become slightly costlier.

2. How does GST 2.0 affect car insurance premiums?

Premiums are lower due to reduced GST on insurance services.

3. Will my existing car loan EMI reduce under GST 2.0?

Yes, marginally. Loan-related charges like processing fees now attract lower GST.

4. Does GST 2.0 impact resale value?

Yes, second-hand cars now have fairer taxation, helping sellers and buyers alike.

5. Who benefits the most from GST 2.0 in the auto sector?

Budget car buyers, EV users, and middle-class families.

FOLLOW TIME OF HINDUSTAN ON FB TO GET UPDATES

Conclusion

The GST 2.0 impact on cars is multi-dimensional. It doesn’t just affect the price tag—it reshapes insurance costs, reduces loan-related expenses, and lowers long-term ownership costs. For the average Indian buyer, this means greater affordability, transparency, and ease of ownership.

If you’re planning to buy a car in 2025 or beyond, keeping an eye on GST 2.0 impact on cars is crucial. Whether you want to save on EMIs, cut insurance bills, or get a better resale deal, GST 2.0 changes the way Indians look at car ownership.

In short, GST 2.0 is a mixed bag for luxury buyers but a big win for the middle-class.