Introduction: BlackRock Bitcoin ETF

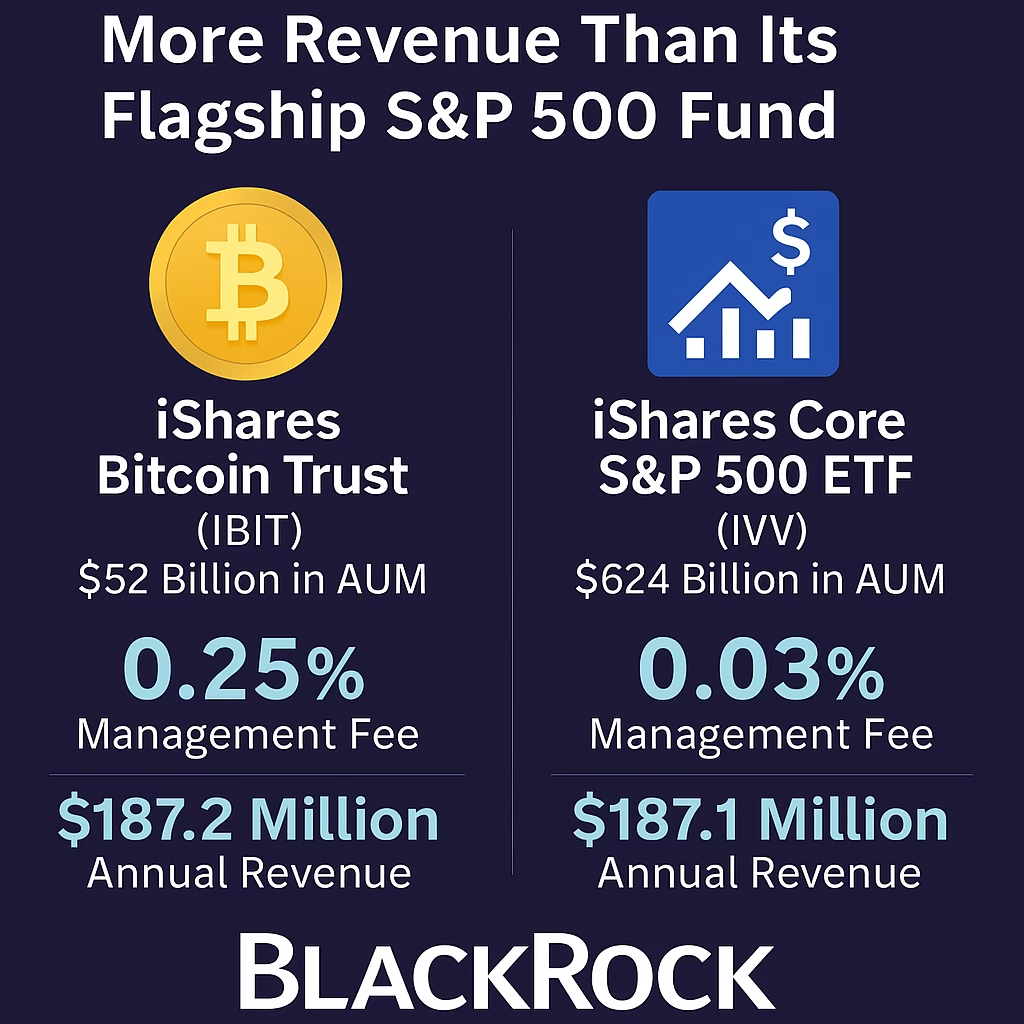

In a surprising turn of events, BlackRock’s iShares Bitcoin Trust (IBIT) is now generating higher earnings than the firm’s flagship iShares Core S&P 500 ETF (IVV), highlighting surging demand for digital‑asset investment products and the expanding role of cryptocurrency in mainstream finance. As per Bloomberg data, despite managing only $52 billion in assets under management (AUM) compared to IVV’s massive $624 billion, IBIT’s fee structure allows it to generate higher annual revenue.

Why IBIT is Outperforming IVV in Revenue

The primary reason for (BlackRock Bitcoin ETF) IBIT’s higher earnings is its 0.25% management fee, which is considerably higher than the 0.03% fee charged by IVV. This fee difference means that IBIT rakes in approximately $187.2 million annually, just edging past IVV’s estimated $187.1 million, despite IVV having nearly 12 times more AUM.

Launched in January 2024, IBIT was part of the first batch of spot Bitcoin ETFs to receive approval from U.S. regulators. Since then, it has consistently attracted investor interest and has become the largest spot BlackRock Bitcoin ETF on the market, quickly amassing $52 billion in assets.

Understanding the Appeal of IBIT

The launch and success of IBIT reflect a broader trend in the financial markets: the growing demand for regulated Bitcoin investment products. Retail and institutional investors are increasingly seeking exposure to Bitcoin, but many prefer the security and simplicity of ETFs over managing crypto wallets and keys themselves.

For many, IBIT offers the perfect balance:

- Access to Bitcoin returns

- No need for private key management

- Institutional-grade security and custody solutions

Although IBIT’s higher fee structure may seem like a downside, it accounts for the additional complexity of managing and securing digital assets, as well as navigating the constantly evolving regulatory landscape.

BlackRock’s Strategic Move into Digital Assets

By entering the Bitcoin ETF market, BlackRock has positioned itself as a leader in the institutional adoption of crypto assets. This move not only diversifies its investment offerings but also aligns with the changing expectations of global investors.

Key reasons why this strategy matters:

- Captures growing crypto demand

- Strengthens BlackRock’s brand in the fintech and crypto sectors

- Taps into younger, tech-savvy investor demographics

The Bigger Picture: Traditional vs. Crypto Investments

The fact that IBIT, a BlackRock Bitcoin ETF, is generating more revenue than a long-standing, market-tracking fund like IVV is significant. It reflects a paradigm shift in the investment world:

- Investors want innovation: Traditional ETFs still hold importance, but there’s growing interest in new asset classes.

- Crypto is becoming mainstream: Regulatory approval and the entrance of firms like BlackRock give legitimacy to digital assets.

- Higher fees can be justified: When products offer unique value and cater to evolving investor needs, investors are willing to pay more.

Chemung Financial (CHMG): A Silent Performer with Growing Potential

While headlines may be dominated by Bitcoin ETFs and tech stocks, smaller financial firms like Chemung Financial (CHMG) are showing robust performance — thanks to strong earnings potential and bullish investor sentiment.

CHMG’s Strengths at a Glance:

- Zacks Rank #1 (Strong Buy)

- Analysts expect 28.57% YoY earnings growth this quarter

- Earnings for the full year expected to hit $5.84/share, up 17.74% from last year

- Forward EPS estimates trending upward

Zacks Rank and What It Means

The Zacks Rank system, which ranges from #1 (Strong Buy) to #5 (Strong Sell), is based on trends in earnings estimate revisions. CHMG’s recent ranking as a #1 stock stems from multiple positive estimate revisions and improving financial metrics.

Why Zacks Rank Matters:

- Zacks #1 stocks historically yield +25% average annual returns

- Estimate trends often precede actual stock price movements

With a solid track record of outperforming the S&P 500, CHMG is a lesser-known gem that’s worth watching.

Market Implications and Investor Takeaways

The success of IBIT and rising prospects of CHMG both indicate significant shifts in the investment landscape:

1. Crypto ETFs Are No Longer a Niche

Regulated crypto exposure via ETFs is becoming a staple for modern portfolios. This is not just a trend — it’s a structural change in asset allocation.

2. Fee Structures Are More Dynamic

Traditional low-cost ETFs may need to innovate or diversify, especially as investors show willingness to pay more for unique exposure or higher-return potential.

3. Small Financial Firms Are Gaining Ground

With large caps dominating attention, mid and small-cap financials like Chemung Financial can offer high growth and portfolio diversification.

4. Regulation Drives Trust

IBIT’s rise also highlights how regulated exposure to crypto makes it more accessible for conservative and institutional investors.

What Should Investors Do Now (BlackRock Bitcoin ETF)?

If you’re a retail or institutional investor, this is a good time to evaluate the composition of your portfolio. Here are some strategies:

- Add crypto exposure through ETFs like IBIT to benefit from Bitcoin’s growth without the risk of managing private keys.

- Keep an eye on smaller financial stocks like CHMG, especially those with strong analyst backing and upward earnings revisions.

- Balance traditional and alternative assets: Diversification is key, and the new generation of ETFs helps you spread your risk.

Conclusion (BlackRock Bitcoin ETF)

BlackRock’s IBIT overtaking IVV in revenue despite its smaller size highlights a new chapter in investment history. As investors look beyond traditional boundaries, BlackRock Bitcoin ETF are proving their worth, offering regulated, high-demand exposure to digital assets. Meanwhile, under-the-radar stocks like Chemung Financial continue to attract savvy investors with strong fundamentals and optimistic earnings forecasts.

This evolution in investor behavior signals a future where traditional and digital assets coexist, and smart money flows to where value meets innovation.

Whether you’re considering an BlackRock Bitcoin ETF like IBIT or hunting for value stocks like CHMG, staying informed and agile is the best investment strategy in today’s fast-changing market.

📌 Stay Updated

Bookmark Time of Hindustan for more news