Stock market information for Bitcoin (BTC)

- Bitcoin is a crypto in the CRYPTO market.

- The price is 109286 USD currently with a change of 78.00 USD (0.00%) from the previous close.

- The intraday high is 109286 USD and the intraday low is 106515.0 USD.

Table of Contents

🇮🇳 Best Indian Crypto Exchanges for Futures Trading in 2025

As India’s crypto trading landscape matures, futures trading is quickly gaining traction among both new and seasoned investors. Whether you’re hedging positions or speculating with leverage, choosing the right crypto exchange with low fees can make a huge difference in your profitability.

In this article, we compare the top 5 Indian crypto exchanges offering futures trading in 2025 — focusing on trading fees, user experience, liquidity, and regulatory stance.

🥇 1. Delta Crypto Exchange

Why It Stands Out: Homegrown and futures-focused.

- Futures Trading Pairs: BTC, ETH, XRP, SOL, and altcoins

- Maker Fee: 0.02%

- Taker Fee: 0.05%

- Max Leverage: Up to 100x

- Key Perks:

- INR deposits via bank & UPI

- Powerful trading dashboard

- Mobile and desktop versions

👉 Best for: Serious derivatives traders who want a low-latency, Indian-optimized platform.

🥈 2. WazirX (via Binance Futures)

Why It Stands Out: Popular Indian gateway to global Binance futures liquidity.

- Futures Trading via Binance account linkage

- Fees: ~0.02% maker / 0.05% taker

- Max Leverage: Up to 125x (Binance cap)

- Key Perks:

- Easy onboarding for Indian users

- Access to global liquidity pools

- WazirX <> Binance wallet integration

👉 Best for: Users who want Binance-level tools while using a familiar Indian interface.

🥉 3. KoinBX

Why It Stands Out: Emerging Tamil Nadu–based exchange with growing futures market.

- Fees: 0.025% maker / 0.05% taker

- Max Leverage: Up to 75x

- Key Perks:

- Fast INR deposit/withdrawals

- Futures + spot combo for traders

- Crypto SIP and staking options

👉 Best for: Traders looking for a rising Indian player with clean UI and low fees.

🏅 4. Bitbns

Why It Stands Out: Veteran Indian crypto exchange expanding into futures in 2025.

- Fees: 0.03%–0.05%

- Leverage: Up to 50x

- Key Perks:

- Smart order types

- Mobile-first design

- BNS token benefits

👉 Best for: Retail traders who want everything (spot + futures) in one place.

🔸 5. CoinDCX Pro

Why It Stands Out: Well-regulated and institutionally backed.

- Fees: 0.04%–0.06% (depending on tier)

- Leverage: Up to 20x (conservative)

- Key Perks:

- Strong security & compliance

- Beginner-friendly dashboard

- Fast INR deposits

👉 Best for: Conservative investors focused on security + legal clarity.

✅ What Is Crypto Futures Trading? (for New Readers)

Crypto futures allow traders to speculate on the future price of cryptocurrencies without owning the actual asset. This means you can go long (betting the price will rise) or short (betting it’ll fall), and use leverage to increase exposure — and risk.

In India, futures are increasingly popular among traders who:

- Want to hedge spot positions

- Prefer short-term trades

- Like using technical indicators with leverage

But remember — futures are not for beginners. Without risk control, you can lose more than your initial capital.

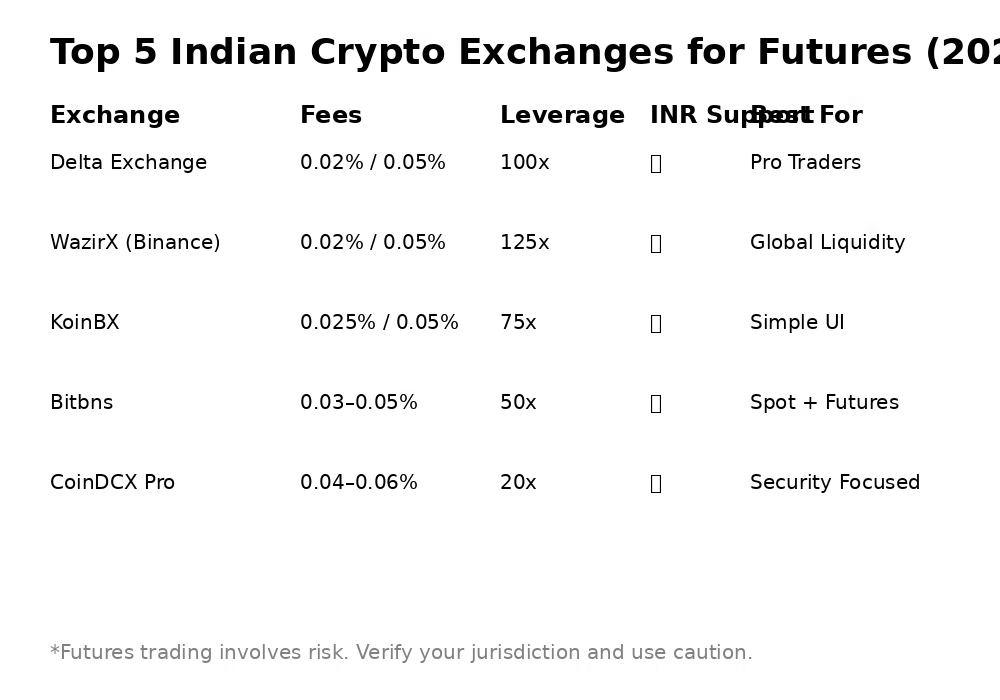

🧮 Fee Comparison Snapshot (2025)

| Exchange | Maker / Taker Fees | Max Leverage | INR Support |

|---|---|---|---|

| Delta | 0.02% / 0.05% | 100x | ✅ |

| WazirX-Binance | 0.02% / 0.05% | 125x | ✅ (via WazirX) |

| KoinBX | 0.025% / 0.05% | 75x | ✅ |

| Bitbns | 0.03–0.05% | 50x | ✅ |

| CoinDCX Pro | 0.04–0.06% | 20x | ✅ |

⚠️ Important Note for Indian Traders

Crypto regulation in India remains in flux. While futures trading is currently operational, always:

- Use platforms with transparent fee structures

- Enable 2FA and withdrawal whitelists

- Declare profits where required under taxation rules

✅ How Fees Impact Profits in Futures Trading

Most traders underestimate the role of trading fees in their PnL (profit and loss). Here’s why:

- Every entry and exit in futures includes maker/taker fees

- If you scalp or trade frequently, fees can eat 5–10% of your monthly returns

- Lower fees = higher profitability, especially with leverage

Example:

A trader makes 20 round-trip trades of ₹10,000 each.

- On an exchange with 0.1% fees, that’s ₹400 in costs

- On an exchange with 0.02%, it’s only ₹80

Over time, that savings stacks up — especially in volatile markets.

✅ Pro Tips for Choosing a Futures Platform in India (2025)

✔ Check liquidity — especially for altcoin pairs

✔ Verify INR deposit/withdrawal support

✔ Use testnet or demo trading first

✔ Review support and dispute resolution channels

✔ Avoid very new crypto exchanges without history or audits

⚠ Warning: Always choose exchanges that comply with Indian tax and KYC laws. Non-compliance can block withdrawals or lead to scrutiny under India’s crypto tax regime.

📌 Final Thoughts

If you’re entering the world of crypto exchanges, low fees and strong security should be your top priorities. Whether you prefer a global option like Binance (via WazirX) or a native player like Delta Exchange or KoinBX, Indian users now have more choices than ever.

Still unsure? Start small, compare platforms, and scale as you learn. 🚀

📌 Stay Updated

Bookmark Time of Hindustan for more News and updates.

Your articles are very helpful to me. May I request more information? http://www.goodartdesign.com

Thank you for writing this post! http://www.ifashionstyles.com

The articles you write help me a lot and I like the topic http://www.hairstylesvip.com

May I request that you elaborate on that? http://www.kayswell.com Your posts have been extremely helpful to me. Thank you!

Today, I went to the beach with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She placed the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

[…] Top 5 Indian Crypto Exchanges for Futures Trading With Lowest Fees in 2025 […]

Thanks for your strategies. One thing we have noticed is always that banks in addition to financial institutions really know the spending patterns of consumers while also understand that plenty of people max out their credit cards around the breaks. They properly take advantage of this particular fact and begin flooding your inbox and snail-mail box by using hundreds of no interest APR credit card offers soon after the holiday season comes to an end. Knowing that if you are like 98 in the American general public, you’ll soar at the possible opportunity to consolidate consumer credit card debt and switch balances to 0 annual percentage rates credit cards.

Your articles are extremely helpful to me. May I ask for more information? http://www.hairstylesvip.com

Thanks for discussing your ideas. Another thing is that scholars have an alternative between federal student loan and also a private education loan where it truly is easier to select student loan consolidation than through the federal student loan.

Thank you for your help and this post. It’s been great. http://www.ifashionstyles.com

Please tell me more about this. May I ask you a question? http://www.kayswell.com

Great content! Super high-quality! Keep it up! http://www.kayswell.com

You helped me a lot by posting this article and I love what I’m learning. http://www.ifashionstyles.com

Please provide me with more details on the topic http://www.hairstylesvip.com

You helped me a lot with this post. http://www.kayswell.com I love the subject and I hope you continue to write excellent articles like this.