🚨 Why Every Crypto Investor Needs This Guide

You must comprehend crypto tax in India in 2025 if you earned any sort of cryptocurrency income in the previous year, whether it was through trading Bitcoin, staking rewards, flipping NFTs, or even airdrops. Ignorance can result in costly fines, audit warnings, or worse, legal issues.

With laws like Section 115BBH and mandatory TDS under Section 194S, the Indian government is strengthening its hold on the cryptocurrency market, making it legally required to report your Virtual Digital Asset (VDA) activity.

From what’s taxable to how to file it, this guide will explain everything in an easy-to-read, conversational style. Let’s begin.

💡 First: Is Crypto Legal in India in 2025?

Yes, crypto is legal but regulated.

The crypto tax in India in 2025 applies to every rupee earned, regardless of whether you buy, sell, hold, or profit from crypto assets. Instead of treating cryptocurrency as money, the government views it as a Virtual Digital Asset (VDA). Therefore, you must report any cryptocurrency transactions you made in 2024–2025 on your ITR this year.

📌 What Types of Crypto Income Must Be Reported?

There are several ways people earn from crypto. The Income Tax Department wants to know about all of them:

- Trading Gains: Buy low, sell high—profit is taxed at a flat 30%.

- Staking Rewards: Considered “income from other sources.”

- Airdrops or Free Tokens: Counted as income at the time of receipt.

- Mining: Treated as business income in most cases.

- NFT Sales: If you created or traded NFTs, that’s taxable.

- Crypto-to-Crypto Swaps: Yes, even if you didn’t convert to INR.

Understanding these sources is the first step in managing crypto tax in India in 2025 the right way.

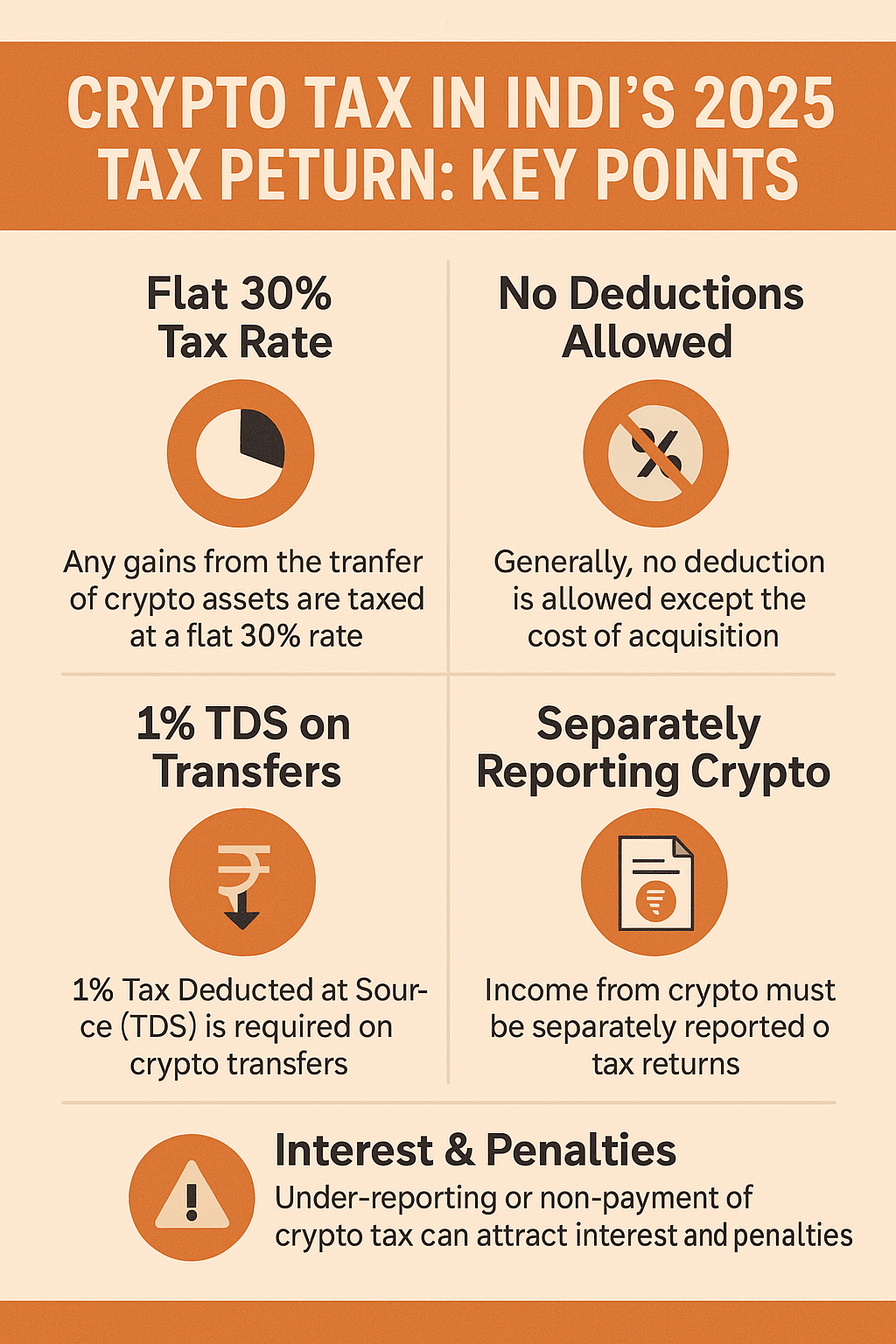

🔎 Tax Rates & Rules You Must Know

Here’s how crypto is taxed under the law:

- Flat 30% tax on all gains

- No deductions allowed (except cost of acquisition)

- No loss set-off or carry forward

- 1% TDS applicable on each transfer/sale

Example:

- You buy ETH at ₹100,000.

- You sell ETH at ₹150,000.

- Your gain: ₹50,000

- Tax: ₹15,000 (30%) + cess

This rate applies whether you made the gain in a few days or held it for over a year. Understanding this structure is crucial for dealing with crypto tax in India in 2025.

🧾 Which ITR Form Should You Use?

Many people mess this up. Choosing the wrong ITR form can result in your return being marked “defective” or even rejected.

Here’s what applies in most crypto cases:

- ❌ ITR-1: Not allowed for crypto income

- ✅ ITR-2: Best for salaried individuals with capital gains or other income (includes crypto)

- ✅ ITR-3: If crypto is your main business or you trade frequently

Pick the correct form to handle your crypto tax in India in 2025 cleanly.

📋 Step-by-Step: How to Report Your Crypto Gains

Let’s simplify the process. Here’s what you need to do:

Step 1: Download Your Transaction History

Get transaction reports from all exchanges you’ve used—WazirX, CoinDCX, Binance, etc.

Step 2: Sort and Classify

Separate the trades: buys, sells, swaps, staking rewards, airdrops, etc.

Step 3: Calculate Profits & Income

Use the FIFO method to compute gains. Platforms like KoinX or TaxNodes help with this.

Step 4: Reconcile TDS

Cross-check your Form 26AS and AIS with TDS deducted on crypto trades. Fix mismatches before filing.

Step 5: Report in the VDA Schedule

In ITR-2 and ITR-3, fill out the VDA Schedule accurately. This is where most people go wrong.

Step 6: File Before Deadline

Filing after the due date attracts penalties and interest. Usually, it’s July 31.

This is the core process for managing crypto tax in India in 2025.

💰 What About Crypto Losses?

Here’s the catch:

You can’t offset crypto losses against gains from other assets. And you also can’t carry forward those losses.

So, if you:

- Lost ₹30,000 in crypto

- Made ₹50,000 in shares

- You still pay tax on the ₹50,000; the crypto loss is ignored.

Keeping this in mind helps you prepare for crypto tax in India in 2025 with fewer surprises.

Crypto Tax in India 2025: How Much Are You Really Paying After All Deductions?

📉 What Happens If You Don’t Report?

If you skip crypto reporting, here’s what could happen:

- 🚨 ITD notice under Section 139(9) or 148

- 💰 Penalties up to ₹5,000 + interest

- 🧾 Form 26AS/AIS mismatch alerts

Crypto scrutiny has gone up significantly. Understanding and preparing for crypto tax in India in 2025 is essential.

📊 TDS: A Silent Watchdog

The 1% TDS rule applies to all crypto sales:

- On Indian exchanges: Deducted automatically

- On foreign exchanges: You need to file Form 26QE and pay manually

Reconcile these entries before final submission to avoid trouble under crypto tax in India in 2025.

🧠 Mistakes to Avoid

Common errors to watch for:

- Filing crypto gains under ITR-1

- Missing wallet-to-wallet trades

- Ignoring small airdrops

- Not reporting staking income

- TDS mismatch

All of these can lead to scrutiny. Keep them in mind when dealing with crypto tax in India in 2025.

🔐 How to Stay Compliant

- ✅ Use crypto tax tools

- ✅ Keep Excel backups of all trades

- ✅ Save all exchange emails and reports

- ✅ Check 26AS & AIS before submitting

- ✅ File through a crypto-savvy CA if needed

Don’t take shortcuts. Follow the process, and you’ll be safe under the crypto tax in India in 2025.

🗓️ Key Dates

- Filing Start: April 1, 2025

- Due Date: July 31, 2025 (unless extended)

- Late Filing Fee: ₹1,000 to ₹5,000 + interest

Meeting these deadlines is crucial for smooth crypto tax filing in India in 2025.

🧾 Documents You Must Keep

- Exchange trade reports

- Wallet addresses & TxIDs

- Form 26AS and AIS

- TDS proof (Form 16A or 26QE)

- Filing acknowledgments

Proper documentation is your best defense during crypto tax audits in India in 2025.

How to Pay Crypto Tax in India (2025): A Step-by-Step Guide

🧭 Final Word: Crypto Is Transparent Now

The government is aware of your trades, whether you like it or not. Tax compliance is now tracked, automated, and enforceable; it is no longer optional.

Don’t be afraid of taxes. Take action and learn. You will be more prepared, self-assured, and audit-proof once you comprehend the crypto tax in India in 2025.

📣 Call to Action

💬 Still confused? Ask your crypto tax question below.

📤 Share this with a friend trading crypto in 2025.

🧾 Need help filing your return with crypto? I can help with a checklist!

[…] How to Report Crypto Tax in India in 2025—Without Getting Notices […]