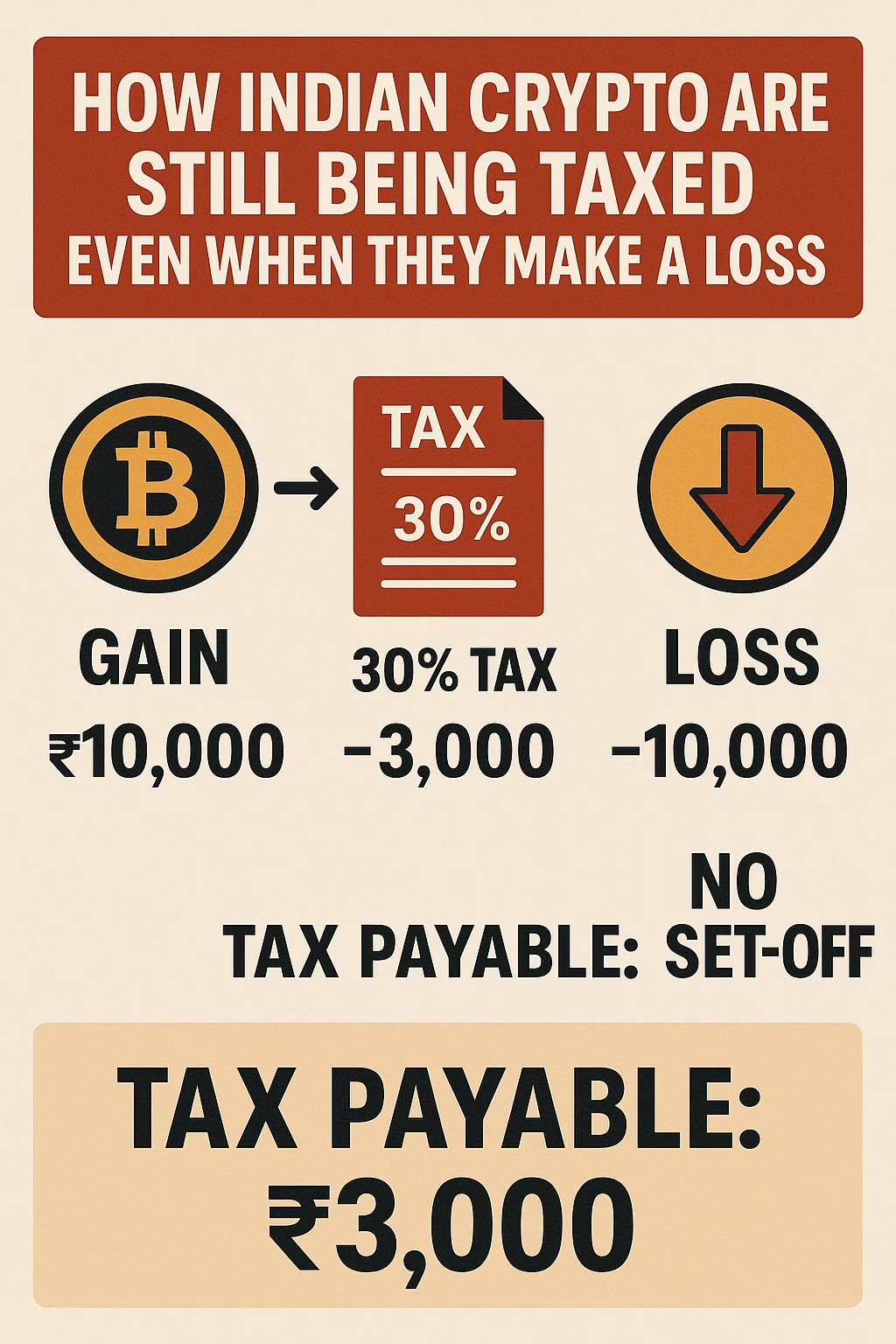

📰 How Indian Crypto Traders Are Still Being Taxed Even When They Make a Loss

When you lose money in a trade, you naturally expect a break—maybe a tax relief, or at least zero tax. But not if you’re a crypto trader in India. In 2025, the situation is crystal clear: crypto tax on losses in India still applies—and it’s affecting lakhs of retail investors who are already struggling to stay afloat.

But how is that even fair? Why does the tax system work this way? And is there any way around it?

Let’s break it down in a way that finally makes sense.

📌 Quick Recap: What Is the Current Crypto Tax Rule in India?

As per the Finance Act 2022, any profits made from the sale of cryptocurrencies in India are taxed at a 30% flat rate. This rule came into effect on April 1, 2022. In addition to this:

- A 1% TDS (Tax Deducted at Source) is applicable on every crypto transaction (buy/sell).

- No deduction is allowed for expenses (except cost of acquisition).

- No set-off is allowed for losses—even against other crypto gains.

And that’s the catch. The crypto tax on losses in India is based on a flat rule—you pay tax on every gain, but you don’t get relief from any loss.

Crypto Tax in India 2025: How Much Are You Really Paying After All Deductions?

🚨 Real Example: Crypto tax on losses in India

Let’s say you made the following trades this year:

- Trade 1: Bought BTC at ₹100,000 → Sold at ₹150,000 → Gain = ₹50,000

- Trade 2: Bought ETH at ₹100,000 → Sold at ₹60,000 → Loss = ₹40,000

You might assume you had a net profit of ₹10,000, right? Not according to the law.

👉 Under current Indian crypto tax rules, you pay 30% tax on the ₹50,000 gain (₹15,000), and the ₹40,000 loss is ignored. You can’t deduct it. You’re left paying more tax than your net earnings.

This harsh reality is what crypto tax on losses in India really looks like.

🔍 Why Doesn’t the Government Allow Loss Set-off?

There are three key reasons:

1. Crypto Is Not Regulated Like Stocks

Unlike the stock market, crypto isn’t considered a security under Indian law. That means it doesn’t fall under the usual capital gains rules that allow loss set-off and carry-forward.

2. Government’s Cautious Stance

The Indian government has been cautious about legitimizing crypto trading. By denying loss set-offs, it’s sending a message: crypto is high-risk and speculative—not encouraged.

3. Revenue Protection

Allowing set-offs would reduce the government’s crypto tax collections, especially since losses far outweigh gains for many traders in a bear market.

Unfortunately, it’s the retail investors who suffer most from this policy.

🧾 How the 1% TDS Makes It Worse

Every time you buy or sell crypto, a 1% TDS is deducted. Even if you make a loss, the TDS still applies. And here’s what makes it worse:

- TDS is non-refundable unless you file returns.

- It locks up your capital and reduces your ability to reinvest.

- You may pay more in TDS than your final profit, especially for frequent traders.

This means that crypto tax on losses in India affects your trades before you even make a rupee of profit.

📉 Impact on Retail Traders

Thousands of Indian crypto users on platforms like WazirX, CoinDCX, and Binance India are feeling the squeeze. Based on surveys and online forums:

- Many traders are net negative in P\&L but have paid lakhs in tax.

- Some are avoiding trading altogether due to the harsh tax regime.

- Others are moving to foreign exchanges or P2P trading, risking compliance issues.

This tax policy is not just confusing—it’s crippling everyday investors who just want a fair system.

⚖️ Are Other Countries Doing It Better?

Yes—and here’s how:

| Country | Crypto Loss Set-off | Flat Tax Rate | TDS |

|---|---|---|---|

| USA | Allowed (Short/Long-Term) | Based on Income Slab | No |

| UK | Allowed | Based on CGT | No |

| Germany | Allowed | 0% if held >1 year | No |

| India | Not allowed | 30% flat | Yes (1%) |

India’s tax treatment is one of the most stringent among major economies. The crypto tax on losses in India is clearly more punitive than elsewhere.

🔧 Is There Any Legal Way to Reduce This Tax Burden?

Yes, but they’re limited:

1. Offset Losses Within the Same Transaction

Some platforms help structure transactions so you can sell loss-making coins first to minimize tax impact, but this only works partially.

2. File Returns to Claim TDS

Always file your income tax returns to claim TDS refunds, especially if your overall income is below the taxable limit.

3. Hold for Long-Term (If Possible)

Avoid frequent trades to minimize TDS and tax. Unfortunately, even long-term gains are taxed at 30% in India, unlike in stocks.

4. Use Gift/Transfer Routes Cautiously

Some traders try gifting coins or transferring across wallets to avoid taxes. But this is risky and may violate Income Tax Act provisions.

Still, none of these options solves the core problem—that crypto tax on losses in India is fundamentally one-sided.

🔍 What Experts Are Saying

Tax experts and crypto influencers have been vocal about this:

“The current tax regime penalizes risk-taking. It’s a one-way street—the government wins whether you win or lose.” – Tax Partner, Big 4 Firm

“Retail investors feel betrayed. When you lose money but still owe tax, it feels like a scam.” – Indian crypto influencer on X

Several petitions have been sent to the Finance Ministry and CBDT for revision. But as of July 2025, no changes have been made.