Over the last few years, cryptocurrencies like Bitcoin, Ethereum, and Solana have exploded in popularity in India. But with popularity comes scrutiny — especially from the Income Tax Department. If you’ve traded, invested, or even received crypto in 2024-25, the big question is: How to declare crypto income in India’s 2025 ITR without penalty?

Failing to report your crypto earnings can lead to hefty fines, tax notices, and even legal trouble. The government is closely monitoring transactions through exchanges, bank accounts, and even blockchain analytics. In this article, we’ll break down the exact process to declare crypto income legally in your 2025 ITR — so you stay safe and stress-free.

Declare Crypto Income in india is Now Non-Negotiable

In 2022, India introduced a 30% flat tax on profits from Virtual Digital Assets (VDAs) like cryptocurrencies and NFTs. Along with that came a 1% TDS on transactions. These rules are now strictly enforced.

Here’s why hiding crypto income is risky in 2025:

- IT Department Tracks Your Transactions – Exchanges like WazirX, CoinDCX, and Binance share user trade data with tax authorities.

- Bank Alerts – Large deposits or withdrawals linked to crypto can trigger compliance checks.

- Blockchain Monitoring – Even wallet-to-wallet transfers are increasingly trackable.

💡 Pro Tip: Even if your crypto is in an international exchange, you’re still liable to pay taxes if you’re an Indian resident.

Types of Crypto Transactions You Must Report in 2025

Before you declare crypto income in India’s 2025 ITR without penalty, you need to know what exactly counts as taxable crypto activity.

- Trading Profits – Selling crypto at a profit.

- Crypto-to-Crypto Swaps – Even if you never convert to INR.

- Mining Rewards – Value of coins mined.

- Staking/Yield Farming Income – Earnings from DeFi platforms.

- Airdrops & Bonuses – Free tokens received.

- Payments in Crypto – If you accepted crypto as payment for services.

🚫 Not reporting any of the above can result in penalty + interest charges.

How to Report Crypto Tax in India in 2025—Without Getting Notices

Step-by-Step: How to Declare Crypto Income in India’s 2025 ITR Without Penalty

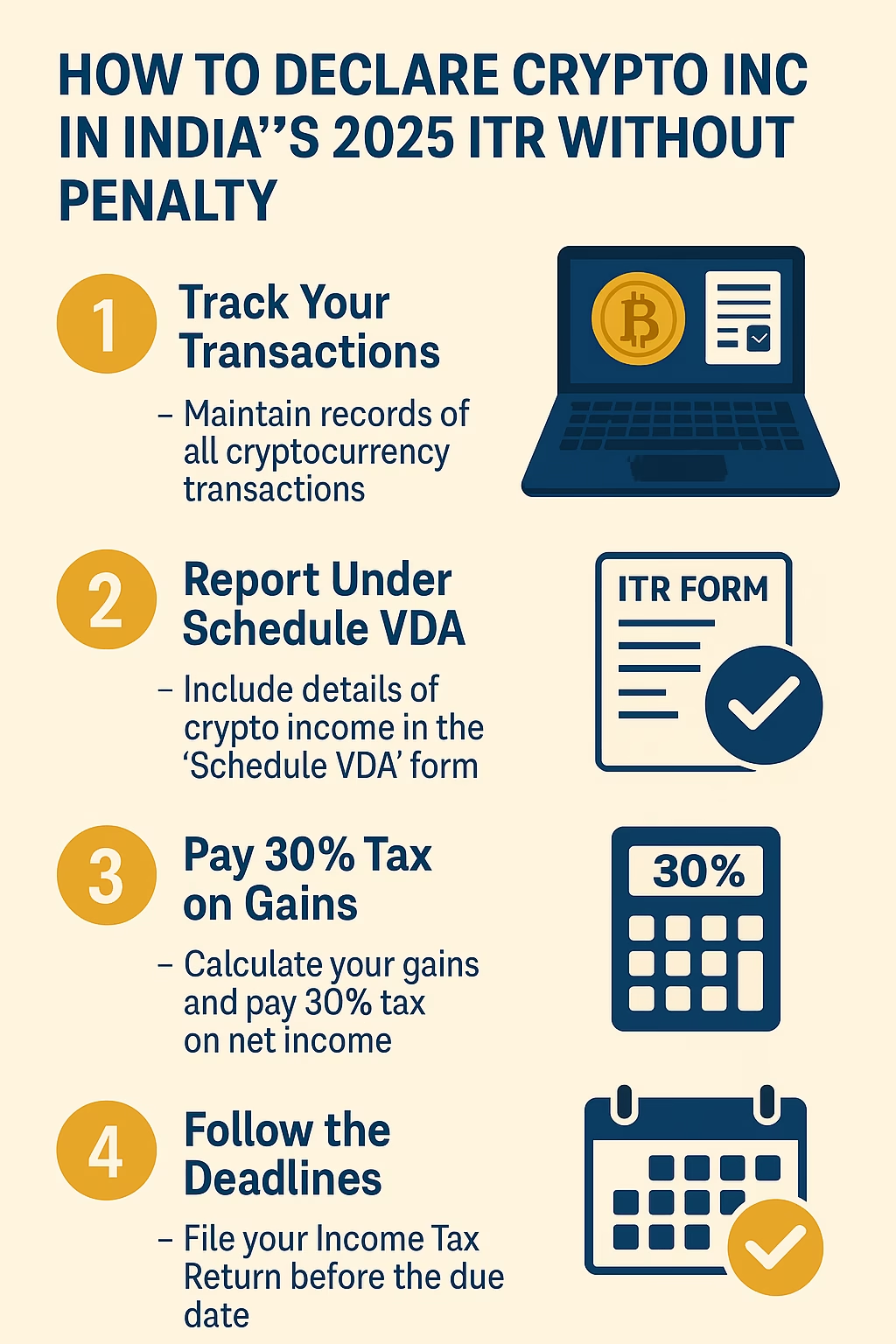

Step 1: Collect All Transaction Data

Gather details from all exchanges and wallets:

- Trade history

- Deposit/withdrawal records

- TDS statements (Form 26AS)

Step 2: Calculate Your Taxable Income

For each transaction:

- Cost of acquisition = Price at which you bought the crypto

- Sale value = Price at which you sold/swapped it

- Profit/Loss = Sale value – Cost of acquisition

💡 Tip: Losses from crypto can’t be set off against other income types, but you should still declare them.

Step 3: Use the Right ITR Form

For FY 2024-25 (AY 2025-26):

- ITR-2 if you have capital gains from crypto but no business income.

- ITR-3 if trading crypto is your main business.

Step 4: Report Under ‘Schedule VDA’ in ITR

The Income Tax Return now has a separate section for Virtual Digital Assets. You’ll need to fill in:

- Date of acquisition & sale

- Purchase & sale price

- TDS deducted

- Net income

Step 5: Pay the 30% Flat Tax + 4% Cess

- Tax rate: 30% on profits

- Surcharge: Depending on income slab

- Cess: 4%

Example: If your crypto profit is ₹1,00,000 → Tax = ₹30,000 + ₹1,200 cess = ₹31,200.

Step 6: File Before the Due Date

The due date for individuals (not subject to audit) for AY 2025-26 is July 31, 2025. Late filing attracts:

- ₹5,000 penalty (₹1,000 if income < ₹5 lakh)

- Interest @ 1% per month

Common Mistakes That Trigger Penalties

Even after knowing how to declare crypto income in India’s 2025 ITR without penalty, many people slip up because of small errors.

- Not Reporting Foreign Exchange Accounts – If you use Binance or Kraken, you must disclose it under Schedule FA.

- Ignoring Small Transactions – Even ₹500 worth of crypto trade is taxable.

- Mismatched PAN Records – Ensure your exchange KYC matches your ITR details.

- Skipping TDS Reporting – The 1% TDS must match Form 26AS.

Penalties for Not to Declare Crypto Income in india’s 2025

| Offense | Penalty |

|---|---|

| Underreporting Income | 50% of tax due |

| Non-reporting of Income | 200% of tax due |

| Late Filing Fee | ₹1,000 – ₹5,000 |

| Interest | 1% per month |

💡 Worst-case scenario: The IT Department can initiate prosecution for willful tax evasion, which carries jail terms.

Pro Tips to Stay 100% Tax-Compliant

- Keep a separate bank account for crypto transactions.

- Use crypto tax calculators like KoinX, TaxNodes, or Quicko.

- Maintain proof of purchase for all trades.

- Report airdrops and staking rewards even if you haven’t sold them.

- File your return before the deadline.

FOLLOW TIME OF HINDUSTAN ON FACEBOOK

Final Word

The safest way to stay away from tax notices and penalties is complete transparency. Knowing how to declare crypto income in India’s 2025 ITR without penalty isn’t just about compliance — it’s about peace of mind.

By keeping accurate records, using the correct ITR form, and paying taxes on time, you can continue your crypto journey confidently while staying on the right side of the law.

Remember: In the eyes of the tax department, “I didn’t know” is never an excuse.

[…] How to Declare Crypto Income in India’s 2025 ITR Without Penalty – Complete Guide […]