🔹 Introduction – The Changing Face of Indian Investments

For decades, Fixed Deposits (FDs) have been the favorite investment option for Indian households. Safe, guaranteed, and backed by banks—FDs were considered untouchable. But in 2025, the story is shifting.

More and more people are searching: “How Indian Investors Use DeFi in 2025 to Earn Higher Returns Than FDs.”

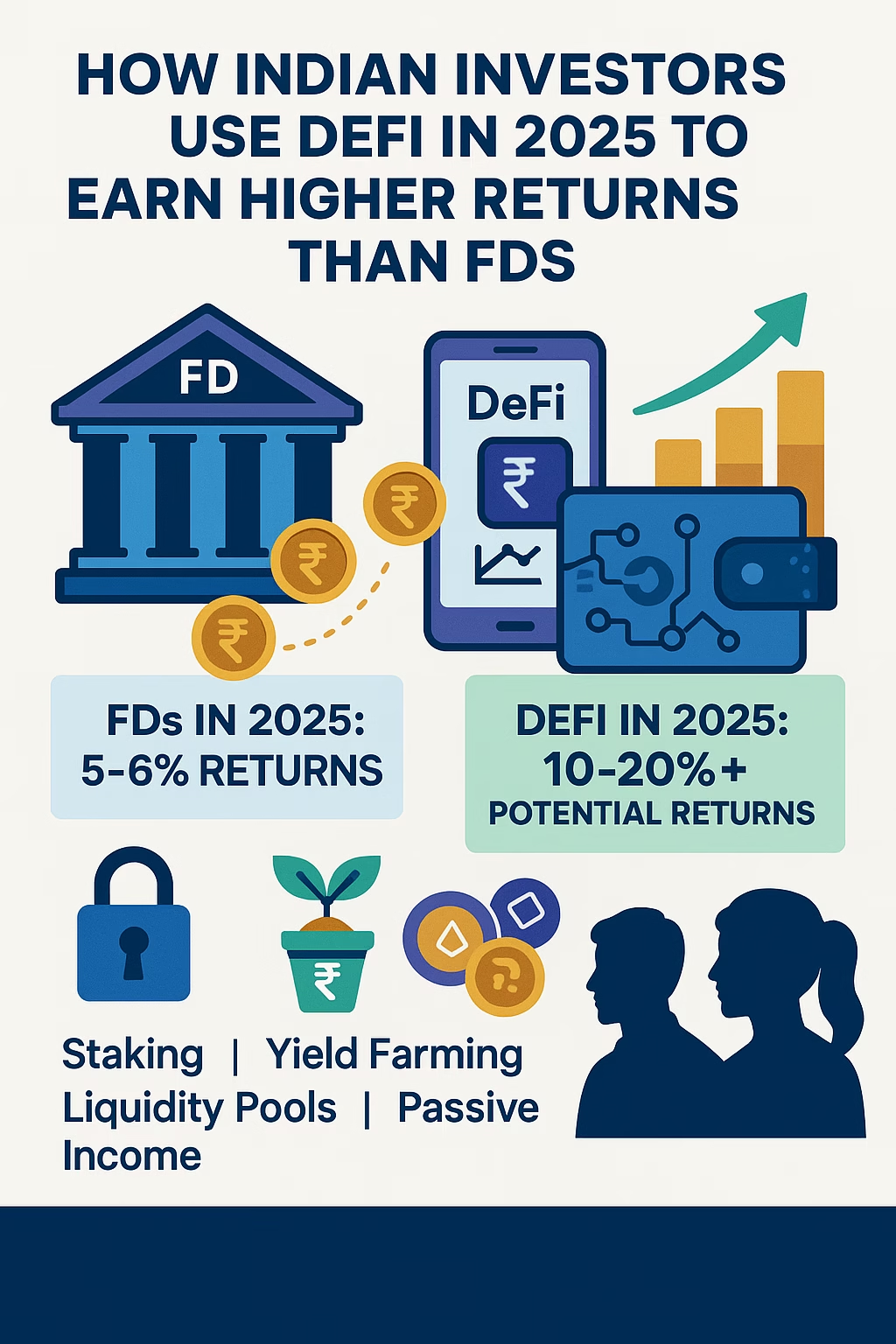

Why? Because while FDs are giving 6–7% returns annually, Decentralized Finance (DeFi) platforms are offering 10–20% returns—sometimes even more. And the best part? Anyone with a smartphone and internet connection can participate.

But is DeFi really the future of investing for Indians, or just another risky fad? Let’s break it down.

🔹 What is DeFi and Why Are Indians Looking at It?

DeFi (Decentralized Finance) is a blockchain-based financial system that removes banks and brokers. Instead, you interact directly with smart contracts—programs that run on blockchain.

Instead of putting ₹1 lakh in an FD with a bank for 7% interest, you could put the same amount in a DeFi lending pool or staking protocol and earn 12–18% annually.

That’s why the question “How Indian Investors Use DeFi in 2025 to Earn Higher Returns Than FDs” is trending—it’s about beating inflation and finding smarter income streams.

🔹 How FDs Compare to DeFi Returns

| Feature | Bank FD (2025) | DeFi (2025) |

|---|---|---|

| Annual Returns | 6–7% | 10–20% |

| Liquidity | Locked (1–5 years) | Flexible (withdraw anytime) |

| Risk | Very low | Medium to high |

| Regulation | RBI-backed | Still unregulated in India |

| Accessibility | Bank account required | Smartphone + crypto wallet |

This explains why younger investors, freelancers, and risk-tolerant Indians are moving toward DeFi.

🔹 Popular Ways Indians Earn with DeFi in 2025

So, how Indian investors use DeFi in 2025 to earn higher returns than FDs? Here are the most common strategies:

1. Crypto Lending Platforms

Investors lend their crypto (like USDT, USDC, ETH) to earn interest.

- Example: Lend USDT and earn 12–15% annually.

- Works like a P2P loan, but without banks.

2. Staking

Lock crypto like Ethereum or Solana to help run networks and earn rewards.

- ETH staking yields ~6–8%.

- Some Indian investors use staking pools for stable returns.

3. Yield Farming

Provide liquidity to decentralized exchanges (DEXs) and earn trading fees + token rewards.

- Example: Liquidity pools on Uniswap or PancakeSwap.

- Returns can go up to 20–30%.

4. DeFi Savings Accounts

New platforms act like “crypto savings accounts” but powered by smart contracts.

- Safer than farming, riskier than FDs.

- Target audience: conservative DeFi users.

5. Tokenized Real-World Assets

Emerging in 2025: Indians investing in tokenized real estate or gold through DeFi.

- Example: Buy fractions of Dubai real estate tokens.

- Returns: rental + appreciation.

RELATED: Top 5 AI-Linked Tokens in 2025 and How to Research Them Safely

🔹 Why Indians Are Choosing DeFi Over FDs

The phrase “How Indian Investors Use DeFi in 2025 to Earn Higher Returns Than FDs” is not just about percentages. It’s about mindset change.

- FD Returns Can’t Beat Inflation – With inflation at ~6%, FD’s 7% is barely keeping up.

- Young Investors Want Flexibility – Millennials/GenZ prefer liquidity and growth.

- Global Income Opportunities – DeFi gives access to worldwide interest rates, not just Indian banks.

- Crypto Adoption Rising – With 25M+ Indians holding crypto, DeFi is a natural next step.

🔹 Risks of Using DeFi Instead of FDs

Of course, it’s not all sunshine.

While exploring how Indian investors use DeFi in 2025 to earn higher returns than FDs, one must acknowledge risks:

- Volatility: Crypto assets can lose value overnight.

- Smart Contract Hacks: If code is buggy, funds may be stolen.

- No RBI Protection: Unlike FDs, no deposit insurance.

- Regulatory Uncertainty: Government may impose restrictions.

This is why experts recommend diversifying—keeping some funds in safe FDs and some in DeFi for growth.

🔹 Real Stories: Indians Earning from DeFi in 2025

- Rohit, 32, Bengaluru Freelancer

- Shifted $2,000 earnings from Upwork into USDT.

- Earns 12% APY on lending platform.

- Says: “My FD gave ₹7,000 in a year, but DeFi gave ₹20,000. I can’t ignore that.”

- Meera, 27, Delhi Marketing Professional

- Stakes Solana (SOL) for passive income.

- Earns ~9% yearly.

- Says: “It feels like a global FD, but faster and more rewarding.”

Such stories highlight how Indian investors use DeFi in 2025 to earn higher returns than FDs in practice.

🔹 Safety Tips for Indians Entering DeFi

Before jumping in, here’s how to stay safe:

- Choose Stablecoins First – Start with USDT, USDC (less volatile).

- Use Trusted Platforms – Aave, Compound, Uniswap have stronger security.

- Check APY Realism – If returns sound too high (>50%), it’s likely unsafe.

- Keep Learning – DeFi evolves fast; don’t invest blindly.

- Don’t Go All-In – Keep FDs for safety, use DeFi for growth.

🔹 Government & Regulation Outlook

India hasn’t banned DeFi, but it hasn’t legalized it fully either. In 2025:

- Crypto taxed at 30% on profits.

- TDS 1% still applies to trading.

- RBI is focusing more on CBDC (Digital Rupee).

Experts believe India may regulate DeFi by 2026, making it safer for common investors. Until then, investors must balance risk vs reward.

🔹 The Future: Can DeFi Replace FDs in India?

So, will DeFi replace FDs? Probably not for everyone.

- Risk-averse families will stick to FDs.

- Young professionals will split funds between FDs + DeFi.

- Freelancers & crypto-savvy youth may go all-in on DeFi.

In other words, the question “How Indian Investors Use DeFi in 2025 to Earn Higher Returns Than FDs” is not about replacing—it’s about supplementing.

FOLLOW TIME OF HINDUSTAN ON FACEBOOK

🔹 Conclusion – A Balancing Act

The rise of DeFi shows that Indians are no longer satisfied with low, guaranteed FD returns. They want better yields, global exposure, and flexible options.

In 2025, how Indian investors use DeFi in 2025 to earn higher returns than FDs is becoming a financial revolution. While risks exist, smart investors are learning to balance both worlds—earning the stability of FDs and the growth of DeFi.

As technology and regulation evolve, one thing is certain: the future of Indian investing won’t just be in banks—it will also live on the blockchain.