Introduction: Why Crypto Tax Matters Now

Cryptocurrency in India has moved from niche curiosity to mainstream asset. The government’s clear stance—30% tax on profits and 1% TDS on every transaction—along with mandatory reporting under Schedule VDA, means it’s crucial for investors and traders to stay compliant

Whether you’re a casual HODLer or a dedicated trader, this guide will help you understand how to accurately calculate, correctly report, and confidently pay your crypto taxes in India.

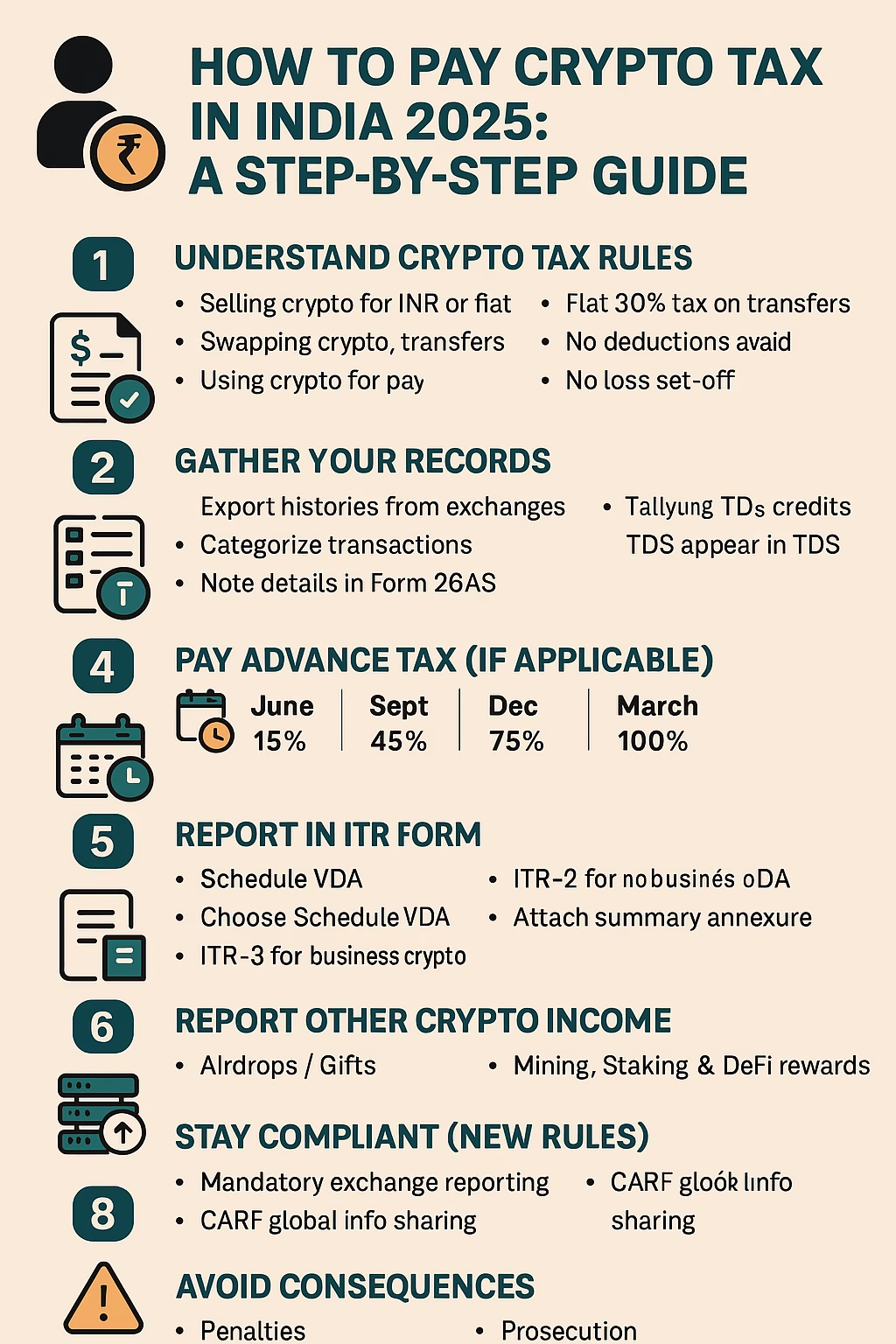

1. Understanding the Tax Rules 📘

A. What’s Taxed?

- Virtual Digital Assets (VDAs) include cryptocurrencies (like Bitcoin, Ethereum), NFTs, and other blockchain tokens

- Taxable events:

- Selling crypto for INR or fiat

- Swapping one crypto for another

- Using crypto as a payment method

B. Crypto Tax Rates

- 30% flat tax on profits (Section 115BBH; no short/long-term distinction)

- 4% cess and applicable surcharge on this tax amount

- 1% TDS on every transfer of VDAs, deducted at source—this is NOT optional

C. What You Can’t Do

- No deductions allowed except purchase price (ignore transaction fees, etc.)

- Losses from crypto cannot offset gains from other income or future VDA gains

2. Getting Your Records in Order 📊

Accurate tracking is critical:

- Export transaction history from all exchanges and wallets.

- Categorize each transaction: buy, sell, swap, spending, gifting.

- Note: date, asset, quantity, INR equivalent, profit/loss, TDS deducted.

📌 Tip: Use a crypto tax tool like Koinly, CoinDCX or KoinX to simplify this

3. Calculating Tax Payable

A. Calculate Crypto Gains

- Use FIFO or another consistent method for cost basis.

- Gain = INR value at sale minus purchase INR value.

- Example:

- Bought 1 BTC at ₹15 lakh, sold for ₹20 lakh → Profit = ₹5 lakh.

- Tax = 30% → ₹1.5 lakh + cess → ₹1.56 lakh.

B. Tally Up TDS

- If TDS was deducted (1% of sale/transfer), you’ll see a credit in Form 26AS.

- This reduces your net tax outgo. If excess TDS was withheld, you’ll get a refund.

4. Paying Advance Tax (If Applicable)

If your tax liability exceeds ₹10,000 in a financial year, you must pay advance tax in instalments:

- 15th June: 15%

- 15th September: 45%

- 15th December: 75%

- 15th March: 100%

If you miss the schedule, interest applies—but no penalties.

5. Reporting Crypto in ITR (Schedule VDA)

A. Choose the Right ITR Form

- Use ITR‑2 (non-business crypto income) or ITR‑3 (if crypto is business income) ([dineshaarjav.com][5]).

B. Fill in Schedule VDA

- Report total transfer value, cost, profit, tax paid, and TDS details .

C. Attach Reports & File

- Submit your crypto summary as an annexure (often required by platforms like CoinDCX).

- File before the deadline: 15 Sept 2025 for FY 2024‑25

6. Reporting Other Crypto Income

- Airdrops / Gifts: Taxable at 30% if value exceeds ₹50,000; gift receiver pays ([coindcx.com][1]).

- Mining / Staking / DeFi Rewards:

- Income taxed as business/income from other sources, then VDA tax applies on later sale.

- Crypto salary:

- Treated as regular income first, then taxed again on VDA transfer

7. Staying Compliant (New Updates)

- Mandatory reporting by crypto exchanges under Schedule 158B, effective FY 2025‑26

- Crypto-Asset Reporting Framework (CARF)—global information sharing—will increase scrutiny

- Penalties exist for non-reporting or misreporting crypto income: penalties, interest, or prosecution

8. Filing Step-By-Step

- Collect transaction history & TDS data

- Use a crypto tax tool to generate gain and TDS report

- Deposit advance tax if due: via Income Tax Portal → e‑pay tax → choose Advance Tax

- File ITR‑2/3: populate Schedule VDA, attach annexure

- Verify ITR via Aadhaar OTP, EVC, or physical return

9. Pro Tips for Filing with Ease

- Track Form 26AS to verify TDS credits.

- Schedule time in July–Sept for accurate filing and renewal.

- Use tax tools (like CoinDCX / KoinX) with exportable Excel/PDF formats.

- Record as you go—monthly backups cut errors.

- Consider CA assistance if trading heavily or running mining/DeFi income streams.

10. Consequences of Non-Compliance

The Income Tax Department has been actively sending notices since Disclosures in Schedule VDA were mandated Ignoring this could result in:

- High penalties (50–200% of tax due)

- Interest on late payments

- Criminal prosecution, including jail sentences ([coindcx.com][1])

📌 Summary Table

| Step | Task | When |

|---|---|---|

| 1 | Download tx history | Monthly |

| 2 | Calculate gains, TDS | Quarterly |

| 3 | Pay advance tax | Jun/Sep/Dec/Mar |

| 4 | Generate crypto tax report | Before ITR filing |

| 5 | File ITR‑2 / Schedule VDA | By 15 Sept 2025 |

| 6 | Verify & retain documents | Post-filing |

✅ Final Thoughts

The crypto tax landscape in India is evolving fast. With flat 30% profits tax, 1% TDS, and mandatory VDA reporting starting this year, staying compliant requires attention but isn’t overwhelming if tracked well.

Start with good record-keeping, leverage crypto tax tools, and file both TDS and annual tax returns diligently. Missed filings or improper reporting can lead to serious consequences—including penalties, interest, and notices from the tax department.

By following this guide, you’ll not only be tax-compliant, but also positioned for smart, confident crypto investing in India’s regulated environment.

✅ Disclaimer:

This article provides educational information only. Consult a registered Chartered Accountant (CA) or a professional tax advisor to match your individual tax situation and comply precisely with the law.

📌 Stay Updated

Bookmark Time of Hindustan for more news

RELATED:Top 5 Indian Crypto Exchanges for Futures Trading With Lowest Fees in 2025

[…] How to Pay Crypto Tax in India (2025): A Step-by-Step Guide […]