Table of Contents

📈 Sacheerome IPO: Launch Date, Business Overview, Market Potential, Risks & Investment Insights

The Sacheerome IPO is making headlines as one of the most intriguing public offerings in the Indian fragrance and aroma chemicals sector. With decades of experience in scent creation and a robust domestic and international footprint, Sacheerome’s entry into the stock market is seen as a strategic move to scale further and capture growing demand across industries.

Here’s a detailed breakdown of the Sacheerome IPO, including its launch timeline, financials, growth prospects, associated risks, and whether you should invest.

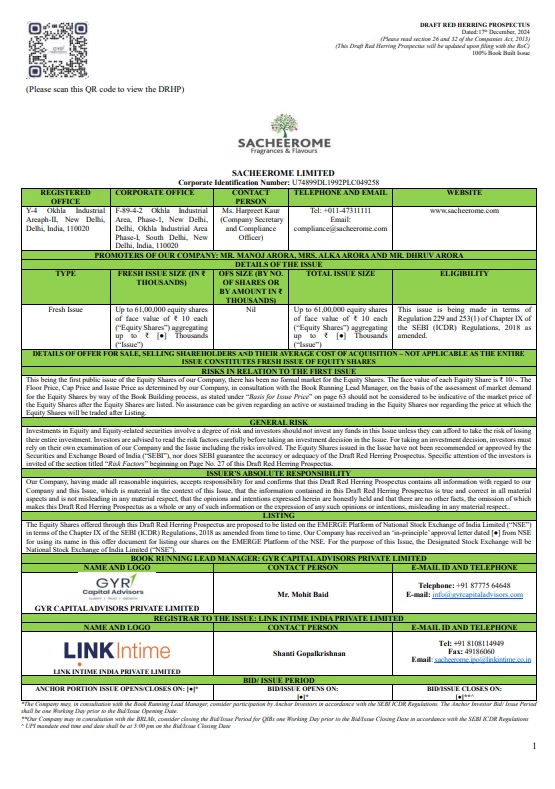

📅 Sacheerome IPO Launch Date & Key Details

| IPO Status | Upcoming (DRHP filed) |

|---|---|

| IPO Launch Date | 09/05/25 -11/05/25 |

| Issue Size | ₹62 Crore (Expected) |

| Price Band | ₹96-102 per share |

| Lot Size | 1200 minimum |

| Listing On | NSE and BSE |

| IPO Type | Book-Built Issue |

| Fresh Issue + OFS | Likely includes both components |

| Lead Managers | MR. Manoj Arora |

📌 Final RHP and price details will be updated once SEBI approves the IPO.

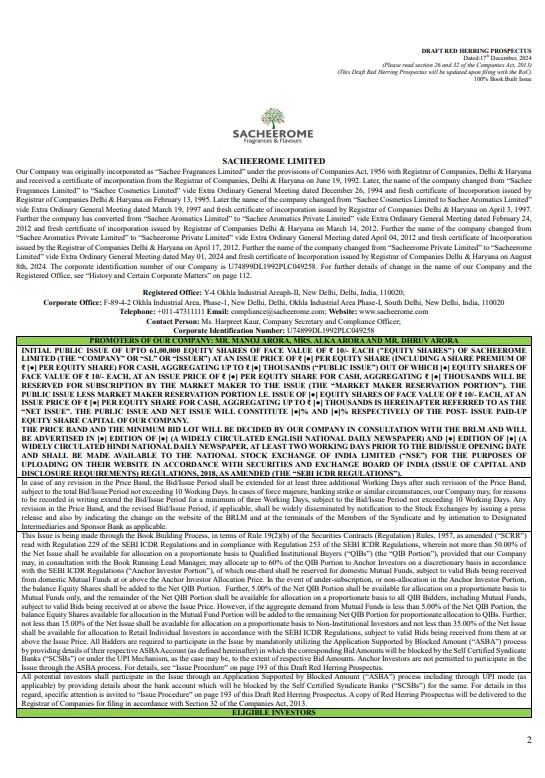

🏢 About Sacheerome: A Leader in Fragrance & Aroma Chemicals

Founded in 1992, Sacheerome Private Limited is a Delhi-based company specializing in the creation of fragrance compositions, essential oils, and aroma chemicals. It serves clients in:

- Personal care

- Household care

- Fine fragrance

- Food & beverages

- Pharmaceuticals

The company supplies both B2B and export markets, competing with players like Givaudan and Firmenich. Sacheerome is known for custom formulation, R&D capability, and sustainable ingredient sourcing.

📊 Financial Overview (As per DRHP)

| Metric | FY23 | FY24 |

|---|---|---|

| Revenue | ₹70.49Cr | ₹85.09 Cr |

| EBITDA Margin | ~18% | ~20% |

| Net Profit | ₹6 Cr | ₹10.61 Cr |

| Export Contribution | 30%+ | 35%+ |

Strong growth is being driven by demand in personal care and FMCG sectors both in India and globally.

🌍 Market Potential for Sacheerome

✅ High-Growth Industry

- The Indian fragrance and flavor industry is projected to reach ₹25,000 crore by 2030.

- The global essential oils market is growing at a CAGR of over 9%, fueled by demand for natural, sustainable, and therapeutic products.

✅ Diverse Client Base

Sacheerome supplies to FMCG, cosmetics, ayurveda, and pharmaceutical brands — all sectors showing double-digit growth in India.

✅ Brand Equity & R&D

The company is respected for quality assurance and innovative product development, giving it a competitive edge in both domestic and export markets.

⚠️ Key Risks of Investing in Sacheerome IPO

1. Raw Material Price Volatility

Natural ingredients like essential oils are vulnerable to supply chain disruptions and price swings.

2. Highly Competitive Industry

Faces strong competition from multinational fragrance houses with global reach and advanced R&D.

3. Regulatory Compliance

Being a chemical-based industry, Sacheerome must adhere to strict safety and environmental norms. Any deviation could lead to penalties or shutdowns.

4. Export-Dependent Growth

A significant portion of revenue comes from exports. Currency fluctuations and global demand slowdowns can impact margins.

💡 Should You Subscribe to Sacheerome IPO?

✅ Reasons to Consider:

- Trusted legacy brand in an expanding niche

- Strong balance sheet and consistent profitability

- Expanding presence in global markets

- Growing demand from wellness, beauty, and FMCG sectors

❌ Reasons to Be Cautious:

- Smaller scale vs. global competitors

- Exposure to raw material and currency risks

- Limited brand recall among retail consumers

📈 Investment Outlook

If priced attractively, Sacheerome IPO could be a solid long-term play in the specialty chemicals and fragrance sector. It offers an opportunity to invest in a niche business that stands to benefit from India’s growing focus on personal care, wellness, and sustainable living.

Ideal for investors with a medium-to-high risk appetite looking for diversification beyond traditional FMCG or pharma stocks.

📌 Final Verdict

The Sacheerome IPO brings an established yet under-the-radar industry player to the public market. With a mix of steady growth, a scalable business model, and global expansion opportunities, it’s worth watching closely.