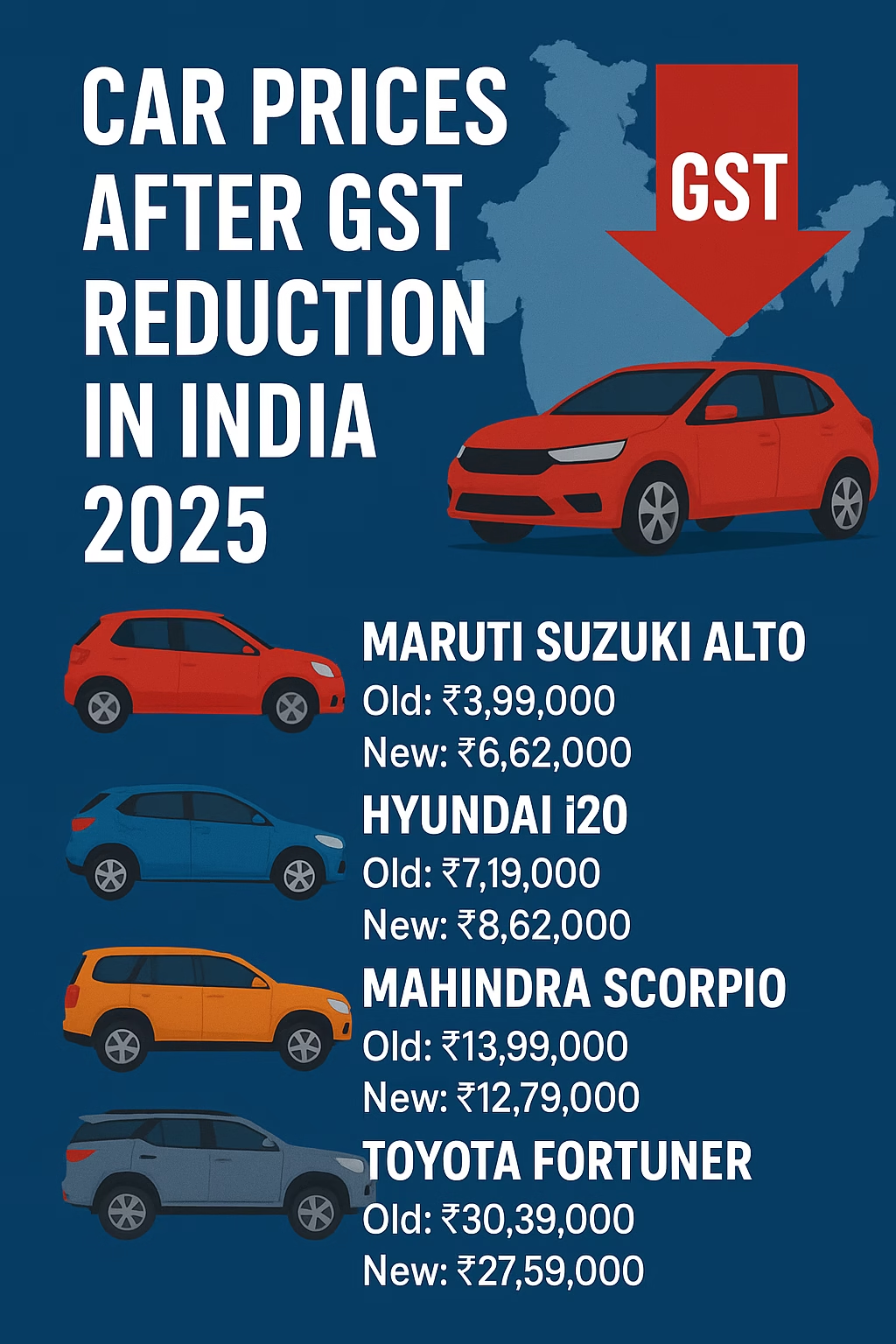

Car prices after GST reduction in India 2025 What Will Cars Cost?

Buying a car in India has always been more than just a purchase—it’s an emotional milestone. For decades, however, high taxation under GST and additional cesses made cars far more expensive than they should be. That changed in September 2025, when the government introduced GST 2.0 reforms, slashing tax rates across automobile segments.

For car buyers, this is nothing short of a revolution. From budget-friendly hatchbacks to premium SUVs and luxury sedans, almost every category has witnessed a price drop. In this article, we’ll provide a detailed price comparison (old vs new) and analyze how the car prices after GST reduction in India 2025 will impact buyers, automakers, and the overall automobile sector.

What Changed in GST 2.0 for Automobiles?

Earlier, cars attracted a hefty 28% GST plus cess, often pushing final costs up by 43–50% of the ex-showroom price. Here’s how the taxation worked before GST 2.0:

Old GST Structure (Pre-September 2025):

- Small cars (hatchbacks, under 4m): 28% GST + 1–3% cess

- Sedans: 28% GST + 15% cess

- SUVs: 28% GST + 22% cess

- Luxury cars & premium SUVs: 28% GST + 25% cess

- Electric cars (EVs): 5% GST

New GST 2.0 Structure (Effective September 2025):

- Hatchbacks: 18% GST, no cess

- Sedans: 20% GST, reduced cess of 5%

- SUVs: 22% GST, reduced cess of 10%

- Luxury cars: 28% GST (no additional cess)

- EVs: 3% GST (down from 5%)

Why This Matters for Car Buyers

- Mass-market cars are now cheaper by ₹50,000 to ₹1.5 lakh.

- SUVs from Mahindra, Hyundai, Kia, and Toyota dropped ₹1.2–2.5 lakh.

- Luxury brands like BMW, Mercedes, and Audi became ₹5–12 lakh cheaper.

- EVs are at their most affordable ever, pushing India closer to green mobility goals.

Clearly, the new Car prices after GST reduction in India 2025 is very attractive, making cars more accessible for millions.

Brand announcements at a glance

- Hyundai: “Up to” cuts range from ₹72,145 (Creta) to ₹1.27 lakh (Verna); sub-4m models like Venue see up to ₹1.23 lakh relief.

- Toyota: Fortuner up to ₹3.49 lakh, Hilux up to ₹2.52 lakh, Vellfire up to ₹2.78 lakh, Innova Crysta up to ₹1.8 lakh.

- Mahindra: Benefits up to ~₹1.56 lakh across the SUV line (Scorpio-N, XUV700, Thar, Bolero Neo, XUV3XO). (www.ndtv.com)

- Tata Motors: Company confirms up to ₹1.5 lakh reduction for ICE portfolio (model-wise details vary by variant).

Note: Maruti Suzuki, Kia, Skoda-VW, Honda, MG, Renault and others are expected to align, but several were yet to publish full model-wise tables at the time of writing. Keep an eye on official bulletins and dealer quotes for final post-22 Sept pricing. (The Economic Times)

How to estimate your new ex-showroom price (the quick math)

If you know your car’s current ex-showroom price PP:

- Small petrol (old ~29% → new 18%): New price ≈ P×1.18/1.29P × 1.18 / 1.29 ≈ P × 0.914 (~8.6% off)

- Small diesel (old ~31% → 18%): New price ≈ P×1.18/1.31P × 1.18 / 1.31 ≈ P × 0.902 (~9.8% off)

- Large SUV (old 50% → 40%): New price ≈ P×1.40/1.50P × 1.40 / 1.50 ≈ P × 0.933 (~6.7% off)

These proportional cuts closely match the “up to ₹” reductions brands have announced.

Old vs New (Indicative) Prices for Popular Models

Method:

- Old ex-showroom = publicly listed base-variant prices current as of Sept 8, 2025 (CarWale/official pages).

- Benefit = the maximum “up to ₹” reduction announced by each brand (actual cut varies by engine/trim).

- Indicative new ex-showroom = Old price minus max benefit (your variant may see less).

Sources shown below each brand table.

Prices are ex-showroom. On-road bills (RTO, insurance) also move a bit lower because they’re computed off the ex-showroom, but state fees and insurer math vary by city.

Hyundai (ICE)

| Model (base variant) | Old Ex-Showroom | Max Benefit Announced | Indicative New |

|---|---|---|---|

| Grand i10 Nios | ₹5.92 lakh | ₹1.08 lakh | ₹4.84 lakh |

| Aura | ₹6.49 lakh | ₹1.02 lakh | ₹5.47 lakh |

| Exter | ₹6.13 lakh | ₹0.92 lakh | ₹5.21 lakh |

| i20 | ₹6.53 lakh* | ₹0.98 lakh | ₹5.55 lakh |

| Venue | ₹6.75 lakh | ₹1.24 lakh | ₹5.52 lakh |

| Verna | ₹11.00 lakh | ₹1.27 lakh | ₹9.73 lakh |

| Creta (E) | ₹11.11 lakh | ₹0.72 lakh | ₹10.39 lakh |

| Alcazar | ₹16.77 lakh | ₹0.39 lakh | ₹16.38 lakh |

Toyota (ICE/Hybrid)

| Model (base variant) | Old Ex-Showroom | Max Benefit Announced | Indicative New |

|---|---|---|---|

| Fortuner (4×2 petrol) | ₹36.05 lakh | ₹3.49 lakh | ₹32.56 lakh |

| Innova Crysta (GX) | ₹19.99 lakh | ₹1.80 lakh | ₹18.19 lakh |

| Innova Hycross (GX) | ₹19.94 lakh | ₹1.15 lakh | ₹18.79 lakh |

| lakh |

👉 These luxury car prices after GST reduction in India 2025 now rival global markets, which could boost imports and domestic sales.

Mahindra (ICE)

| Model (base variant) | Old Ex-Showroom | Max Benefit Announced | Indicative New |

|---|---|---|---|

| Thar 2WD (diesel RWD) | ₹11.50 lakh | ₹1.35 lakh | ₹10.15 lakh |

| Scorpio-N (Z2 petrol) | ₹13.99 lakh | ₹1.45 lakh | ₹12.54 lakh |

| Bolero Neo (N4) | ₹9.97 lakh | ₹1.27 lakh | ₹8.70 lakh |

Tata Motors (ICE)

| Model (base variant) | Old Ex-Showroom | Company-Stated Max Benefit | Indicative New |

|---|---|---|---|

| Tiago | ₹5.00 lakh† | up to ₹0.75 lakh | ₹4.25 lakh |

| Tigor | ₹6.00 lakh† | up to ₹0.80 lakh | ₹5.20 lakh |

| Altroz | ₹6.89 lakh | up to ₹1.10 lakh | ₹5.79 lakh |

| Punch | ₹6.20 lakh | up to ₹0.85 lakh | ₹5.35 lakh |

| Nexon | ₹8.00 lakh† | up to ₹1.55 lakh | ₹6.45 lakh |

| Harrier | ₹15.00 lakh† | up to ₹1.40 lakh | ₹13.60 lakh |

| Safari | ₹15.50 lakh† | up to ₹1.45 lakh | ₹14.05 lakh |

| + |

👉 The new Car prices after GST reduction in India 2025 clearly show major relief for families planning to buy popular hatchbacks and SUVs.

Will on-road prices also drop?

Yes—RTO tax and insurance are computed on ex-showroom, so a lower ex-showroom cascades into a slightly lower on-road figure. But RTO slabs and insurance premiums are state- and insurer-specific, so your final on-road may not fall exactly by the same rupee amount as the ex-showroom reduction. (Example city price pages show how on-road builds from ex-showroom with RTO/insurance.) (

Quick FAQs

Q1) Do EV prices change after the GST cut?

No. EVs remain at 5% GST, unchanged. Any EV price moves would be due to separate company decisions, not this tax change.

Q2) Why do some compact cars get a bigger rupee cut than bigger SUVs?

Because many compact ICE cars moved from ~29–31% effective tax to 18%, a ~9–10% drop; large SUVs moved from 50% to 40%, ~6.7% off. On a lower MRP, a 9–10% drop can still translate to a chunky “₹ up to” figure.

Q3) My brand hasn’t announced a new list yet—what should I do?

Use the quick math above to estimate, then ask your dealer for a written ex-showroom proforma reflecting post-Sept 22 billing. Many OEMs have said more detailed lists are incoming.

Q4) Are hybrids treated like petrol cars?

For tax purposes under the old regime, hybrids were in the higher slab; under GST 2.0, they benefit where they fall into the 40% bucket—hence sizable “₹ up to” cuts on models like Camry and Vellfire. Your exact hybrid variant’s benefit will follow the OEM’s sheet.

RELATED :Mahindra Vision 2027: How India’s SUV Giant Is Driving the Future of Mobility

Takeaways (and how to shop smart right now)

- Time your invoice: To capture the benefit, ensure the invoice date is Sept 22, 2025 or later.

- Lock variant & colour early: Popular trims (e.g., Creta/Scorpio-N mid-specs) may face longer wait times once cuts kick in.

- Get a post-cut price breakup: Ask for city-specific ex-showroom, RTO and insurance after the GST change, not just “on-road in round figures.” (Dealers’ city pages show how the breakup works.)

- Cross-shop rivals: Compact ICE cars see the largest percentage drop—great time to compare Venue vs Nexon vs Exter vs Punch (or equivalent in your budget).

Sources & further reading

- GST 2.0 slabs & effective date: Times of India explainer; Economic Times roundup of OEM moves.

- Hyundai model-wise benefit sheet: NDTV Auto (model-wise “up to ₹” list).

- Toyota “up to ₹” list (Fortuner/Hilux/Vellfire/Innova etc.): NDTV Auto.

- Mahindra “up to ₹” table (Thar/Scorpio-N/XUV700/Bolero Neo/XUV3XO): NDTV Auto.

- Tata Motors confirmation of cuts: India Today.

- Old base ex-showroom pages used for tables: CarWale & Cardekho city/variant pages for each model referenced.

Conclusion – Why Now Is the Best Time to Buy a Car

The car prices after GST reduction in India 2025 mark a historic turning point for the automobile industry. Whether you’re eyeing a budget hatchback, a family SUV, or even a luxury car, the savings are substantial. From ₹50,000 cuts in mass-market cars to ₹10 lakh savings in luxury vehicles, the benefits are undeniable.

With the festive season approaching and dealers offering extra discounts, now is the best time to upgrade your car. Not only do you save upfront, but you also secure long-term value in a market that’s finally turning buyer-friendly.