Introduction

Have you ever wondered who really calls the shots at the world’s biggest companies? You might assume it’s the CEOs or board members, but in reality, a handful of giant investment firms like BlackRock, Vanguard, and State Street have massive control – all through mutual funds and ETFs that millions of regular people invest in. And here’s the kicker: you might own shares in a company, but someone else is voting on your behalf.

That brings us to an important but often overlooked question: how to trace mutual fund voting power? If you’ve ever Googled this and came away more confused, you’re not alone. This article breaks it down step by step in plain language, so you finally understand who holds the power, how they use it, and how you can find out where your investment vote really goes.

In a world where trillion-dollar companies shape economies and influence governments, understanding voting power in mutual funds isn’t just for financial nerds. It affects:

- Climate policy (via shareholder proposals)

- CEO pay and leadership decisions

- Mergers and acquisitions

- Social responsibility and ESG trends

BlackRock and Vanguard now own significant portions of nearly every major U.S. company. Yet, most people who invest through mutual funds or retirement plans don’t even know how their shares are being voted.

So let’s uncover how to trace mutual fund voting power in a way that’s simple, transparent, and practical.

What Is Mutual Fund Voting Power?

When you buy shares in a mutual fund or ETF, you don’t directly own shares in individual companies. The fund itself owns them. That means fund managers vote on shareholder decisions like board elections, executive compensation, and corporate strategies on your behalf.

This is called proxy voting, and it’s a big deal.

- A mutual fund with 5% ownership in a company can swing a vote.

- The “Big Three” (BlackRock, Vanguard, State Street) collectively own more than 20% of the S&P 500.

- You, as an investor, typically have zero input unless the fund allows pass-through voting (which is still rare).

So the next time someone asks you who controls Google, Apple, or ExxonMobil – the answer might be: your mutual fund provider.

BlackRock Bitcoin ETF Beats S&P 500 Fund in Revenue – What It Means for Investors

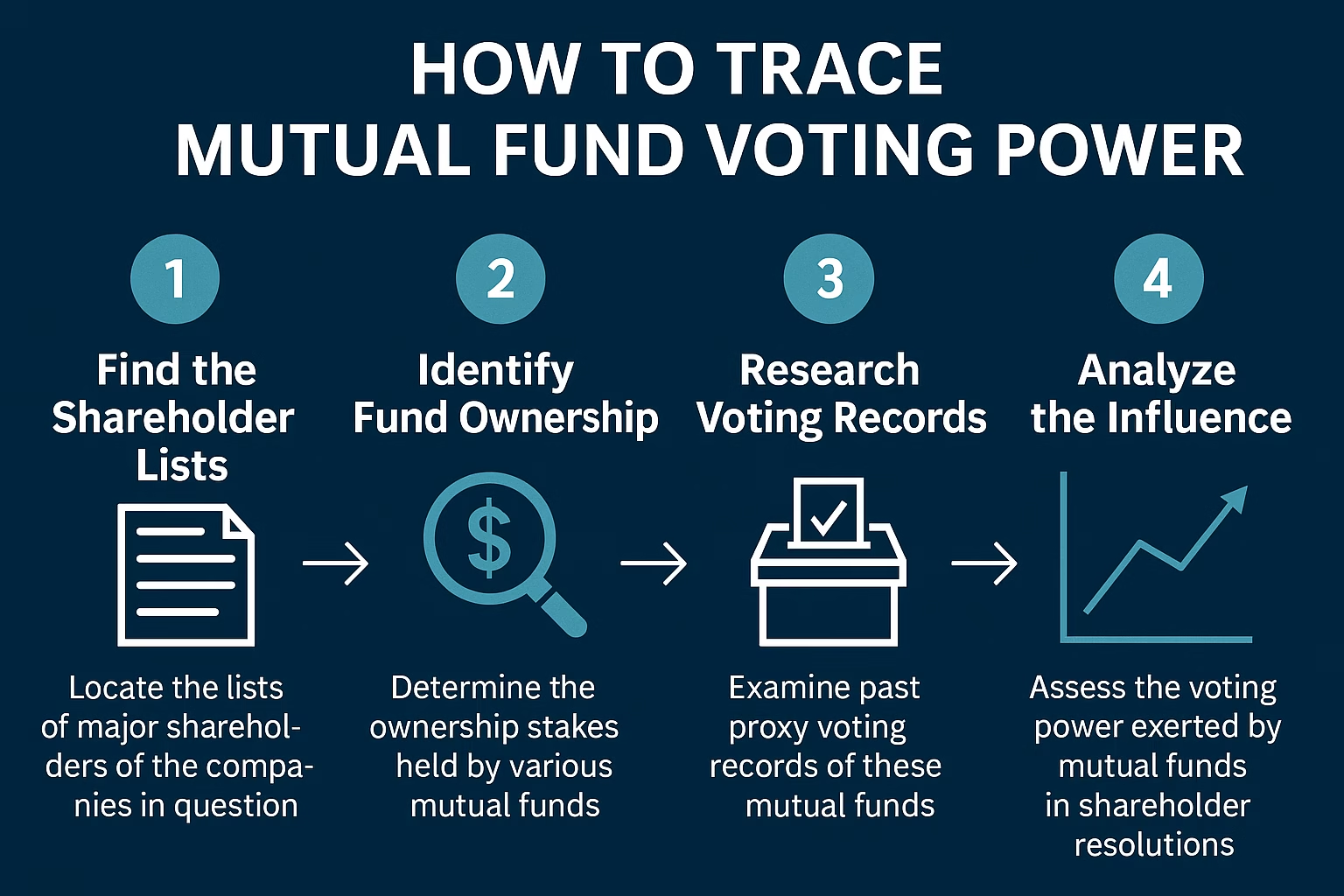

Step-by-Step: How to Trace Mutual Fund Voting Power

Let’s break it down into a beginner-friendly process. Here’s how to trace mutual fund voting power using free public tools:

1. Know the Fund Name or Ticker

Example: You invest in “Vanguard Total Stock Market Index Fund (VTSAX).”

2. Go to the Fund’s Official Website

- Look for a section called “Proxy Voting Policies” or “Fund Governance.”

- Vanguard, BlackRock, Fidelity, and others publish annual proxy voting records.

3. Check the SEC’s EDGAR Database

- Visit: https://www.sec.gov/edgar

- Search for the fund’s name or ticker

- Look for Form N-PX: This shows how a mutual fund voted in shareholder meetings during the year.

4. Use Free Tools Like FundVotes.com

- https://www.fundvotes.com

- Offers side-by-side comparisons of how various fund families voted on key proposals

- Includes votes on climate change, board diversity, CEO pay, and more

5. Review Voting Trends by Topic

Most voting data is categorized into:

- Environmental (e.g., carbon disclosures)

- Social (e.g., gender diversity)

- Governance (e.g., board elections)

You can trace patterns, like how BlackRock might support ESG proposals one year and reject them the next.

6. Look for New Pass-Through Voting Features

In 2023 and 2024, firms like BlackRock and Fidelity started testing pass-through voting, allowing big institutional clients and, in some cases, retail investors to direct their votes. If your fund offers this, opt in to have more say.

Real-World Example: Apple Inc.

Let’s say you’re curious about who voted on Apple’s executive compensation in 2024.

- Go to Apple’s annual proxy statement (available via EDGAR)

- See the list of proposals

- Visit Vanguard, BlackRock, and Fidelity’s voting records (also on EDGAR or fund sites)

- Find how each voted (For, Against, Abstain)

It’s not uncommon to find:

- Vanguard: FOR

- BlackRock: AGAINST

- Fidelity: ABSTAIN

Different voting strategies give insight into how fund managers view the company and their internal policies.

Key Players Who Control the Most Votes

As of 2025, here’s a look at who holds major proxy power:

| Asset Manager | Total AUM (Approx.) | Voting Power |

|---|---|---|

| BlackRock | $10 Trillion | 5-7% in most S&P 500 firms |

| Vanguard | $8 Trillion | 6% average stake in 500+ companies |

| State Street | $4 Trillion | Influential in ESG votes |

| Fidelity | $4.5 Trillion | Selective on social proposals |

They publish annual stewardship reports that explain how they vote and why.

Why It’s So Hard to Trace Voting Power

Despite the tools above, tracing how to trace mutual fund voting power can be frustrating. Here’s why:

- Lack of standardization: Each firm formats reports differently

- Opaque language: Reports are often full of legal or corporate jargon

- Lag in publishing: Voting records can be delayed up to a year

That’s why user-friendly platforms (like FundVotes or Morningstar) are so important for simplifying the process.

What You Can Do as an Investor

✅ 1. Read the Fund’s Proxy Policy

See if their values align with yours. If they vote against climate or diversity measures, you may want to reconsider.

✅ 2. Support Funds with Pass-Through Voting

Some ETFs are beginning to allow you to vote directly. Keep an eye on these.

✅ 3. Switch to Values-Aligned Funds

Look for ESG or activist funds that vote in alignment with your views.

✅ 4. Ask Your Broker Questions

You’re the customer. Ask how your votes are handled and whether you can opt in.

The Future of Mutual Fund Voting in 2025 and Beyond

- AI-Driven Voting Bots: Some funds are testing AI models to guide voting on shareholder resolutions

- Real-Time Voting Dashboards: Tools that let you track how your fund is voting in near real-time

- Blockchain Records: To secure and verify proxy votes transparently

- SEC Push for More Transparency: New rules may soon require faster and more detailed disclosures

The trend is moving toward democratizing proxy voting, but we’re not there yet. Until then, education is your best defense.

Thank you for the clarification! Since your focus keyword is:

🔍 “how to trace mutual fund voting power”,

here are 4+ natural, human-sounding lines you can add to your article that use this keyword seamlessly and help with SEO:

🧠 Why Importance To Learn How To Trace Mutual Fund Voting Power

If you’re an investor who holds units in mutual funds, you might not realize it—but your investment gives you a say in major corporate decisions. That’s why it’s essential to know how to trace mutual fund voting power in 2025.

Thanks to regulatory reforms and tech tools, learning how to trace mutual fund voting power is no longer a mystery. Platforms like SEBI’s voting disclosures and mutual fund house reports allow investors to see exactly how their funds voted on issues like board elections, mergers, and ESG policies.

Knowing how to trace mutual fund voting power empowers you to align your investments with your values. Want your money to support climate action, labor rights, or ethical governance? Then you must understand how to trace mutual fund voting power and use that insight when choosing your fund house.

As awareness grows, more investors are asking fund managers for transparency. They want to know not just where their money is parked—but how it speaks. And that starts with understanding how to trace mutual fund voting power step-by-step.

Conclusion

If you’ve made it this far, congrats—you now know more about how to trace mutual fund voting power than 99% of retail investors. This knowledge is powerful. Not only can it help you invest smarter, but it can also help you take part in shaping corporate policies that affect society at large.

The next time you hear about a big corporate vote, remember: the real power may lie not with the CEOs, but with your fund manager.

FAQs

Q1. Is it possible to vote on my shares if I invest through mutual funds?

In most cases, no. But some funds now offer limited pass-through voting options.

Q2. How do I know if my mutual fund supports ESG proposals?

Check the fund’s proxy voting record or stewardship report on their website.

Q3. Are proxy votes public?

Yes. U.S. law requires funds to file Form N-PX annually, showing their voting record.

Q4. Can mutual funds influence corporate decisions significantly?

Absolutely. Major asset managers can swing decisions on everything from mergers to climate policy.