A New Take on the S&P 500 ETF Debate

Exchange-traded funds tracking the S&P 500 ETF remains the gold standard for U.S. equity investing. Giants like Vanguard’s VOO, SPDR’s SPY, and iShares’ IVV dominate in assets and popularity. But with a few mega-cap stocks now making up over 20% of the index—and the top 10 accounting for roughly 38%—investors are beginning to wonder if these big wins also bring big risks (etf.com).

BlackRock’s Alternatives: Why Now?

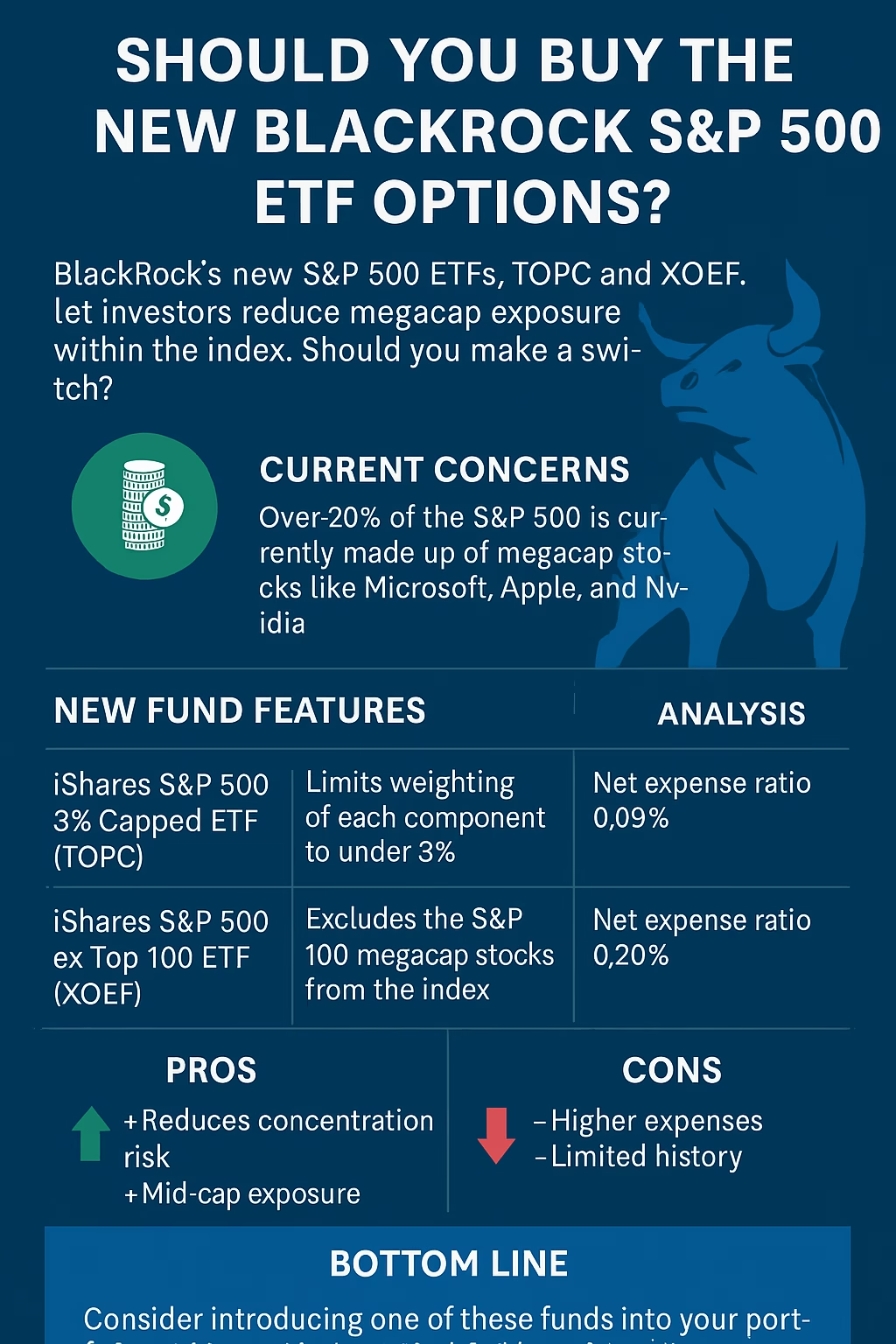

Concerned about the S&P 500 ETF being dominated by mega-caps, BlackRock launched two innovative ETF options:

- iShares S&P 500 3% Capped ETF (TOPC): Caps any holding at 3%, redistributing excess to smaller companies

- iShares S&P 500 ex Top 100 ETF (XOEF): Excludes the largest 100 stocks (i.e., the S&P 100), offering broader large-cap diversity (BlackRock).

These funds allow investors to reduce overweight megacap exposure within the S&P 500 ETF portfolio while maintaining broad market participation.

Product Details at a Glance

| ETF | Ticker | Strategy | Net Expense Ratio |

|---|---|---|---|

| TOPC | S&P 500 3% Capped ETF | Caps holdings >3% | 0.09% (0.15% gross) |

| XOEF | S&P 500 ex Top 100 ETF | Excludes top 100 | 0.20% |

| VOO / IVV / SPY | Core S&P 500 ETF | All 500 stocks, market-cap-weighted | ~0.03% (VOO), ~0.04% (IVV), ~0.094% (SPY) |

For dedicated S&P 500 ETF investors, the trade-off is clear: concentrated risk vs. higher costs for broader equity diversification.

TOPC: Capping Mega-Caps

TOPC debuted in April 2025 with $10 million in AUM . It limits any company’s weight to 3%, redistributing excess to smaller names, resulting in more balanced sector exposure. For example, tech exposure is ~23% vs. ~31% in traditional S&P 500 ETF options.

- Pros: Reduces concentration risk, more diversified sector mix.

- Cons: Slightly higher fee (0.09% vs. ~0.03%), short track record.

XOEF: Removing the Big Fish

XOEF launched July 9, 2025, cutting all S&P 100 heavyweights . Jay Jacobs of BlackRock notes it’s a tool to “manage mega-cap concentration with precision”.

- Pros: Greater upside potential from mid-large caps; avoids overcrowded top-tier stocks.

- Cons: More expensive (0.20%), may underperform if mega-caps keep leading.

Cost vs. Concentration: Core S&P 500 ETF Remains King

Core S&P 500 ETF options like VOO and IVV charge just 3–4 basis points, comparably cheaper than TOPC or XOEF. These established funds include mega-caps that historically drive index returns.

Studies show the top-performing large caps have been responsible for most S&P 500 ETF gains over decades—even while many individual stocks underperformed . Thus, capping or excluding them may mean missing out on key drivers.

BlackRock Bitcoin ETF Beats S&P 500 Fund in Revenue – What It Means for Investors

Should You Shift Away from Core S&P 500 ETF?

Consider TOPC If:

- You’re seeking balanced exposure across sectors.

- You’re wary of overconcentration in a few mega-caps.

- You don’t mind paying extra for diversification.

Consider XOEF If:

- You want profitable exposure beyond the top 100.

- You’re confident mid-large caps will outperform mega entities.

- You can stomach performance drag if mega-caps continue to surge.

Stick with VOO/IVV If:

- You’re a buy-and-hold investor.

- Fees matter most—as low as possible.

- You embrace long-term dominance of mega-cap growth.

A Balanced Approach to S&P 500 ETF Investing

- Dollar-cost average into a low-cost S&P 500 ETF—maximize returns over time.

- Tactical allocation: Add 5–10% via TOPC or XOEF if rebalancing away from mega-caps.

- Monitor performance: Check if capping enhances or hinders your portfolio over 6–12 months.

Final Thoughts

BlackRock’s S&P 500 ETF variations—TOPC and XOEF—offer thoughtful strategies to combat mega-cap dominance. But they add complexity, cost, and limited historical data.

For most investors, sticking with a core S&P 500 ETF like VOO or IVV remains the simplest and most cost-effective choice. Dollar-cost averaging remains a proven strategy that maximizes gains from mega-cap winners.

If you’re in the “explorer” camp, consider modest allocations to TOPC or XOEF. But remember: diversification’s benefit comes at a price—and that price includes potentially missing out on the heavyweights that drove past performance.

Key Takeaways on S&P 500 ETF Options

- Core S&P 500 ETF (VOO/IVV/SPY) = lowest cost, maximum mega-cap exposure.

- TOPC = caps at 3%, more balanced sector stance, fee 0.09%.

- XOEF = excludes top 100, focus on mid-large caps, fee 0.20%.

- Extensive research favors mega-cap wins; capping may reduce returns.

- Strategy: Use core ETFs for foundation; add limited exposure to alternatives if desired.

Bottom line: If you’re building your financial future over decades, a low-cost S&P 500 ETF remains hard to beat. For those seeking greater anti-concentration or seeking new growth, BlackRock’s capped and ex-top-100 options are worth exploring—just keep allocations small and expectations clear.